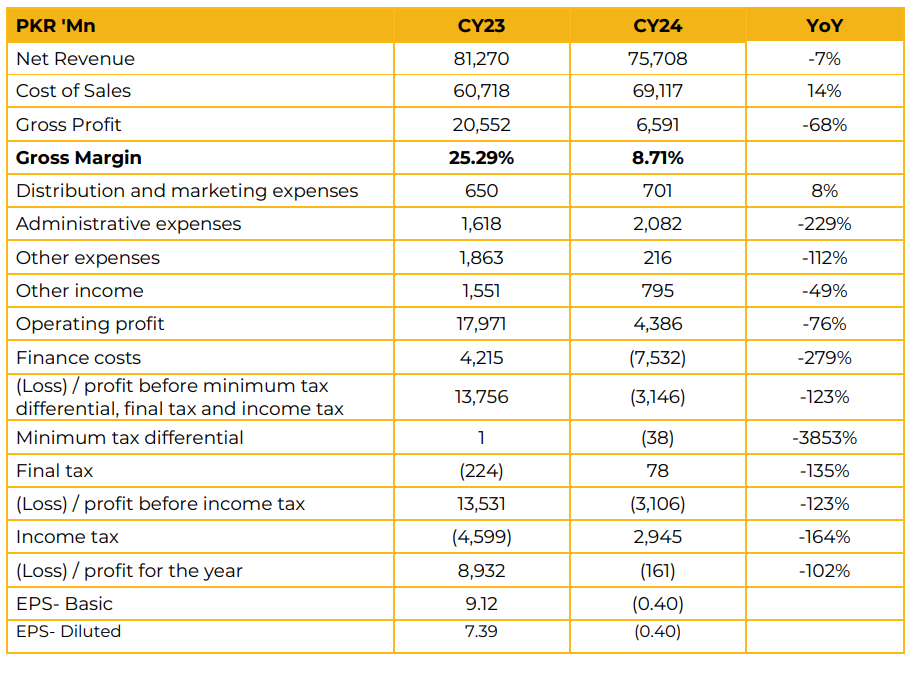

In CY24, Engro Polymer & Chemicals Limited (EPCL) reported a net loss of PKR 160.58 million (LPS: PKR 0.40), compared to a net profit of PKR 8.93 million (EPS: PKR 9.12) in the previous year.

Revenue declined by 7% YoY to PKR 75.71 billion, primarily due to lower international PVC prices, partially offset by higher domestic sales of caustic soda and PVC. Exports declined by 50% YoY to USD 13 million.

The drop in EBITDA was attributed to a lower core delta and higher gas prices. The higher margins in Q4 resulted from a reassessment of the useful life and residual value of our plants, leading to lower depreciation for the quarter.

Hydrogen Peroxide projects are expected to be commissioned in 1QCY25. Revenue segmentation stood at 81% from PVC and 19% from the Chlor-Alkali segment. PVC production declined to 212KT in CY24 from 230KT in the SPLY due to preponed January outage in September CY24, while CSL production remained stable at 95KT. VCM production dropped to 216KT from 224KT, with no VCM imports reported in FY24.

Total inventory stood at 20KT in cY24 PVC prices hit record lows, while the core delta declined to around $337 due to oversupply, rising feedstock prices, and new plant startups in the US, China, Thailand, and Qatar. Sluggish construction activity and geopolitical factors further dampened PVC demand. Current PVC prices stand at $760/ton.

However, management does not anticipate further price cuts due to narrow producer margins, instead focusing on optimizing operating rates. Industrial gas prices have risen to PKR 3,500/MMBtu, and gas availability remains a challenge. EPCL is engaged with key ministries to explore alternative energy solutions, including coal-based power generation.

Despite an 8% decline in the cement sector, the domestic PVC market grew by 8%, supported by PVC imports of 40KT. Downstream PVC product demand increased by 20-25%. The company maintained its market share through a stable pricing strategy and ensured product availability, with 53% of sales directed to the pipes and fittings segment. Management noted that short-term borrowings helped lower the cost of sales.

Looking ahead, lower interest rates are expected to drive domestic PVC demand, while core delta and margins are likely to remain stable in CY25 due to lower PVC prices and range-bound ethylene prices. Favorable macroeconomic indicators are expected to support higher PVC demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.