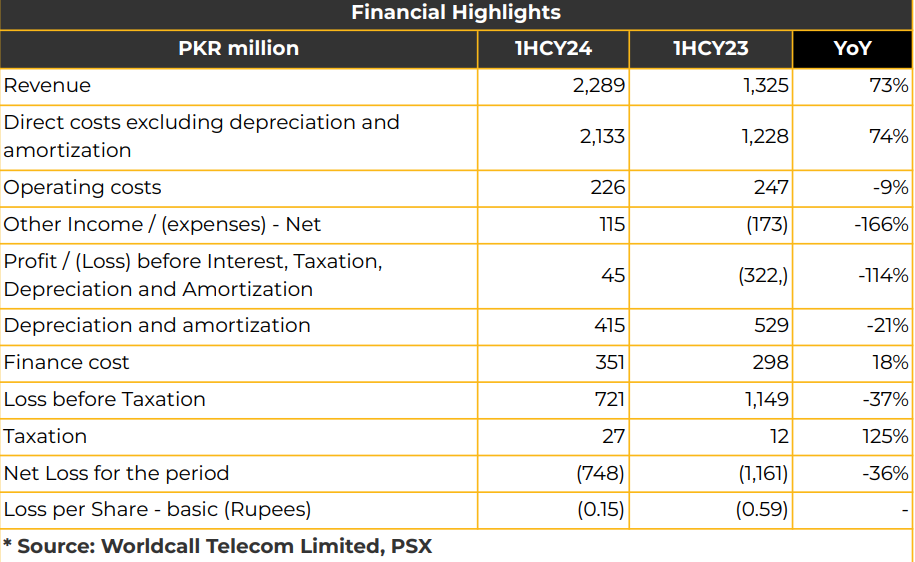

In 1HCY24, Worldcall Telecom Limited (WTL) reported a net loss of PKR 747.71 million (LPS: PKR 0.15), improving from a net loss of PKR 1.16 billion (LPS: PKR 0.59) in 1HCY23. Net sales increased by 73% YoY to PKR 2.29 billion, up from PKR 1.33 billion in the prior year. EBITDA turned positive due to technology transformation initiatives. The Company earned PKR 78 million from FTTH connections in 1HCY24.

Direct costs rose 74% YoY to PKR 2.13 billion while operating costs contracted by 9% YoY to PKR 225.61 million. Depreciation and amortization expenses declined by 21% to PKR 415.22 million. Finance costs increased 18% YoY to PKR 351.22 million. WTL has an asset base of PKR 13.33 billion, and its ultimate holding company is Global Tech Corporation (GLTK: OTC US)

The company’s strategy is focused on expanding its fibre optic network, technological investments in CADNZ, KRYTRON, and WBS, and increasing its international reach through Global Tech. The company is also investing in subscriber acquisition for its broadband services, with 10,000 connections already activated in partnership with World Mobile Group (WMG) in Lahore, targeting 200,000 broadband subscriptions. The focus is shifting from business services to consumer services while upgrading existing services to FTTH for better margins and lower operational costs.

WTL projects revenue growth from multiple sources in the next three years, expecting PKR 1 billion from CADNZ, PKR 500 million from Krytron, PKR 759 million from its Center of Excellence (CEC) focused on AI and Big Data, and PKR 300 million from Global Tech operations. CEC will provide access to new markets and products. CADNZ is a digital lending platform targeting the USA, Middle East, and Africa, with its first client expected in 1QCY25. KRYTRON aims to handle PKR 22 trillion in transactions by providing infrastructure services, while Global Tech will focus on back-office services and management solutions.

Additionally, WTL has signed contracts for its Bill Care product. Global Tech’s financing plans for World Call include a TFC-III settlement and a funding plan of USD 5-10 million (as per Global Tech’s 10-K SEC filings). Loan settlements are being arranged to strengthen the balance sheet.

A back-office service contract worth USD 1.2 million annually is under negotiation. The company’s global footprint spans Dubai, Muscat, and the USA, with planned expansion into Europe by March 2025 and Australia by 3QCY25. WTL currently covers 3.2 million households across 20 regions for BTS connections and aims to add 3-6 cities each quarter for fibre optic consumer services. In the Middle East, WTL projects a market size of 1 trillion dirhams.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.