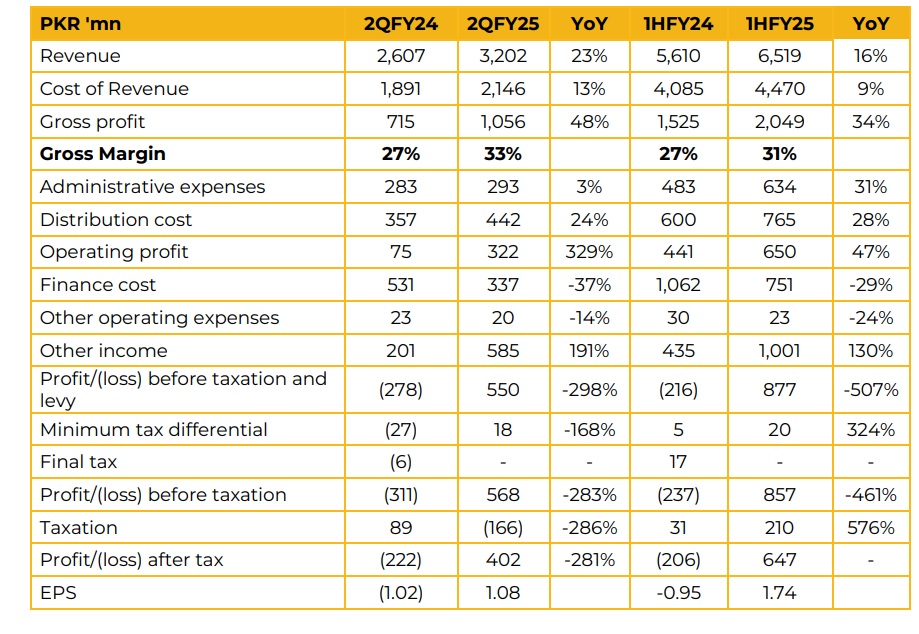

Treet Corporation reported a net profit of PKR 647.05 million (EPS: PKR 1.74) in 1HFY25, a turnaround from a net loss of PKR 206.36 million (LPS: PKR 0.95) in the previous year.

The improvement was driven by pricing adjustments, a strategic shift toward high-value, highmargin products, and portfolio diversification. Local sales grew to PKR 5.59 billion in 1HFY25. Doubleedged and hygiene blades were key contributors to revenue growth. Management reported increase in price, while volumes declined by 4.4% YoY. Operating expenses remained elevated due to inflationary pressures.

Operating profit increased, primarily due to a PKR 594 million gain from the divestment of TBL. In 1HFY25, the company introduced a disposable Treet blade targeting the KSA market during pilgrimages and established a subsidiary in the UAE to expand exports to African markets. Financing costs declined 29% YoY to PKR 751.37 million, attributed to lower interest rates, the divestment of TBL, and the issuance of a rights issue in FY24. Management anticipates further reductions in financing costs over the next three to six months. In TBL, sales grew 16% YoY to PKR 4.20 billion, while the net loss declined to PKR 174 million in 1HFY25. Price reductions were offset by volume growth. Warranty costs increased by 7% YoY, while advertising expenses declined by 13% YoY.

Renacon Pharma Limited recorded a 24% YoY revenue increase to PKR 801 million in 1HFY25, driven by price increases and volumetric growth. However, finance costs rose 36% YoY, impacting net profitability, which declined 8% YoY to PKR 99 million from PKR 107 million in the SPLY. The company is currently exporting pharmaceutical products to 15-17 countries and expects a temporary dip in net profitability over the next three to six months due to the transition to the new facility. Renacon Pharma Limited’s listing remains in progress. Renacon Pharma inaugurated the Renacon Faisalabad Facility in January 2025 for hemodialysis solutions.

The company holds a 60-70% market share in the hemodialysis segment, and the new facility is expected to be five times larger than the previous one. TBL is in the final stages of lithium-ion battery development, with a focus on capacity utilization and exploring new opportunities. The current capacity utilization is 60-70%. Management anticipates a positive impact from net metering policies on solar battery storage systems.

Treet Corporation’s overall market share remains below 10%. Lead battery volumes are increasing, and the company anticipates a downward pricing trend, which is expected to be favorable for its operations. The corrugated packaging segment faced challenges, but the company maintained profitability and currently ranks 6 th or 7th in the market. The soap business remained profitable, primarily targeting southern Punjab. Going forward, management maintains a positive outlook on the battery business, expecting the next 6-18 months to be a period of growth. Export leads for Renacon Pharma products exceed 20 countries, with major focus on Eastern Europe. The company’s key focus remains on debt servicing, while personal care products are also in the pipeline.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose