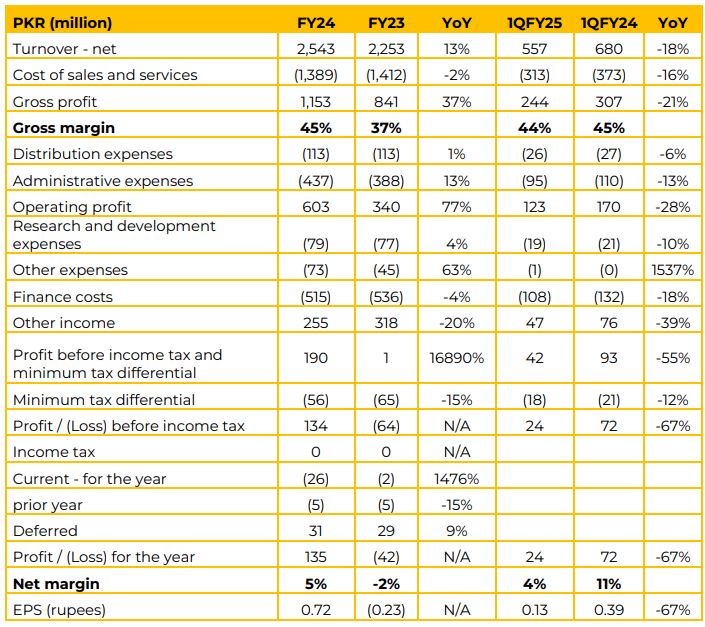

TPL Trakker reported a 13% year-on-year (YoY) increase in net turnover for FY24, reaching PKR 2,543 million, driven by growth in its telematics and IIoT segments.

However, 1QFY25 turnover declined by 18% YoY to PKR 557 million. TPL Trakker’s EPS turned positive in FY24 at PKR 0.72, compared to a loss of PKR 0.23 in FY23.

However, in 1QFY25, EPS declined to PKR 0.13, down 67% YoY due to reduced profitability during the quarter. TPL Trakker remains a market leader in telematics with a 39% share in Pakistan, offering comprehensive solutions in vehicle tracking, fleet management, and IIoT. It is the only licensed provider of digital mapping in the country and a sole bonded cargo tracker.

The company has leveraged its expertise to address evolving market demands across logistics, FMCG, ridehailing, and government sectors, focusing on vehicle tracking, fleet management, and location services. TPL Trakker’s subsidiary, Trakker Middle East (TME), has entered a strategic partnership with the Gargash Group, one of UAE’s leading business enterprises. Gargash will acquire a 50.1% equity stake in TME, injecting fresh capital to accelerate growth in the Middle East.

The partnership is expected to enhance the company’s reach and showcase its IoT products across GCC markets. Legal processes have concluded, and equity injection is anticipated by December 2024.

TPL Trakker’s Smart Farm Management solution leverages IoT technology to optimize agricultural operations, enhance productivity, and ensure sustainability. Key features include soil and crop monitoring, equipment tracking, and expert advice, enabling data-driven decision-making. The solution helps farmers increase yields, improve resource efficiency, mitigate risks, and modernize farming practices through actionable insights and real-time monitoring.

TPL Maps provides digital mapping, geospatial analytics, and location-based services, featuring Pakistan’s largest geospatial database. Its Location Intelligence platform supports industries like banking and retail with analytics for network planning and marketing.

The company offers solutions like live tracking and route optimization, and is expanding into the GCC, with key clients including UBL, HBL, and Khaadi. Going forward, for FY25, TPL Trakker aims to expand its IoT applications across logistics, agriculture, and energy sectors, introduce intelligent fuel tracking solutions to optimize consumption and reduce costs, and target corporate fleets with AI-powered dashboards for predictive maintenance and cost optimization.

The company plans to offer scalable telematics platforms for logistics, retail, and manufacturing, along with enhanced asset tracking and condition monitoring for high-value assets. Management expects 20% increase in the revenue for FY25. Additionally, the introduction of smart home solutions will expand its market reach.

Positive impacts on revenue and profitability are expected from the growth of IoT and smart solutions, increased corporate fleet sales, demand for fuel management, expanded telematics offerings, and regional growth in the GCC, particularly through the partnership with Gargash Group.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.