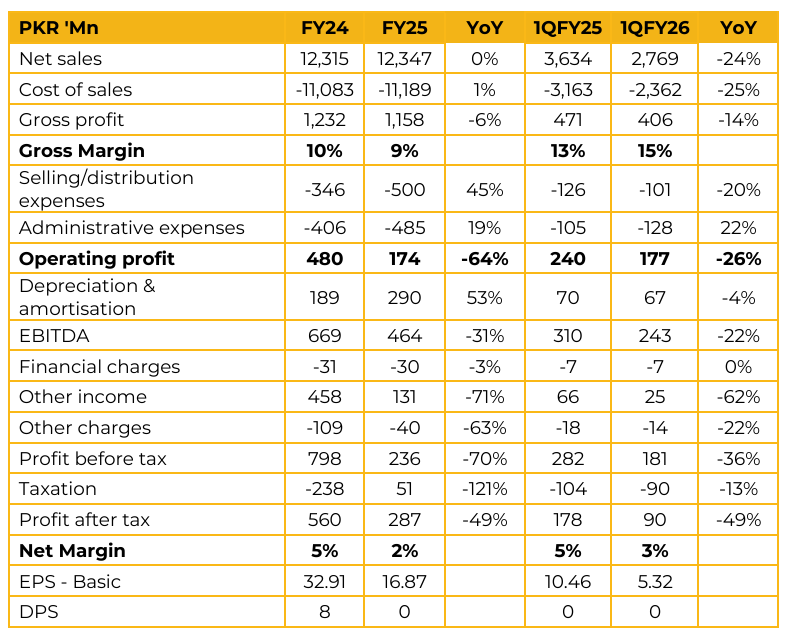

Towellers Limited (TOWL) reported earnings per share of PKR 16.87 for FY25, compared to earnings per share of PKR 32.91 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 5.32, compared to earnings per share of PKR 10.46 in the same period last year (SPLY).

The company is currently operating at close to 80% capacity utilization. Ongoing investments are focused primarily on efficiency enhancements rather than immediate capacity expansion, as the new factory buildings remain under construction and its part of the company’s five year growth plan.

Management indicated that margin improvement will depend largely on the global demand environment particularly a recovery in North America rather than solely on the commissioning of new machinery. They also noted that some key customers are currently experiencing short term liquidity constraints; once those eases, the company expects purchasing patterns to normalize. Towellers Limited does not have an in-house spinning unit; instead, it manages raw material procurement by closely monitoring market trends and leveraging long-standing relationships with spinning partners.

Seasonality continues to play a key role in performance. Q1 is typically the strongest quarter, while Q2 usually observes subdued sales. Management is hopeful that Q3 will deliver a better than usual outcome this year due to changes in the tariff structure. The strong profitability recorded in FY2023 was driven by a combination of sharp currency devaluation, high interest rates, and government incentives.

The company’s solar installation now caters to approximately 40% of total electricity requirements, significantly reducing reliance on thermal energy. The estimated payback period for this investment is around five years. Management reiterated that there is no fixed dividend policy going forward, with payouts dependent on capital expenditure requirements and overall liquidity.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.