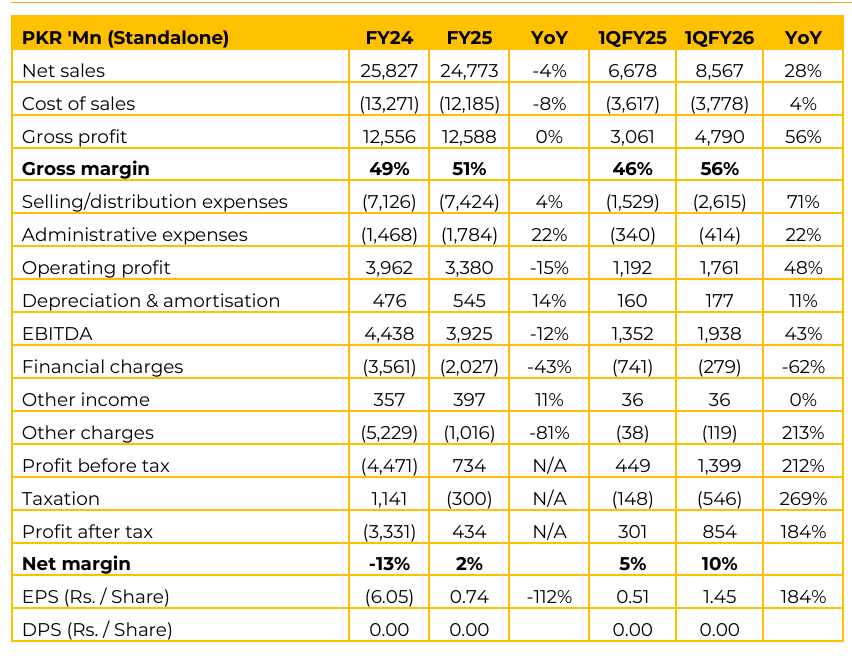

SEARL reported earnings per share of PKR 0.74 in FY25 vs loss per share of PKR 6.05 in FY24. In 1QFY26, the EPS remained PKR 1.45 (1QFY25: 0.51). Sales were slightly lower than FY24 due to supply chain issues and internal consolidation efforts. The de-regulation of prices has been a favorable development, leading to increases in gross margins, particularly for the non-essential portfolio. SEARL operates across Pharmaceuticals, Biopharmaceuticals, Nutraceuticals, Nutrition, Consumer, and Medical Disposals categories.

The company has six manufacturing facilities; three in Karachi and three in Lahore, which are described as having sufficient capacity to support future growth. Six brands are in the PKR 1 billion Plus Sales Club. Eight brands cross PKR 500 million in annual sales. Extor ~ PKR 5 billion, Nuberol Forte ~ PKR 4 billion, Hydryllin ~ PKR 3 billion, and Tramal & Peditral ~ Over PKR 1 billion each. Extor is the largest product of SEARL and the largest in the cardiovascular market.

The major portfolio split between chronic and acute disease categories is approximately 50-50%. The company claims to be number one in chronic areas like cardiovascular and neurology. Management noted that post price de-regulation, industry growth peaked at 23-24%. It is expected to normalize to around 17-18% going forward.

Volumetric growth is anticipated to move from near zero to 4-5%. Overall value growth for the industry is expected to be between 15% and 20%. Going forward, management is targeting approximately 23% volumetric growth and slightly less than 40% value growth for FY26. Gross margin reached 55% in the first quarter. Management expects to sustain this margin level for the current fiscal year as pricing is currently under control.

Management anticipates SEARL’s growth to be double (or slightly more than double the market growth, attributing this to aggressive market strategies aimed at regaining lost share from a poor base effect in the previous year. Biologics are one of the two main focus areas, with the goal of becoming the number one biological company in Pakistan.

Biologics are a low-volume, high-value market. SEARL is currently manufacturing four biologics namely Adalimumab, Enoxaparin Sodium, Epoetin Alfa, and Filgrastim. Plans are underway to develop five additional biologics within the next year, including Semaglutide, Tirzepatide, and Denosumab, along with two monoclonal antibodies that were previously imported from Europe.

This expansion is expected to significantly increase the capacity utilization of the purpose built biologics facility and enhance margins. Exports contribute approximately 11% to 12% of revenue. Exports are a high-margin area and a core focus for the future. SEARL is currently the only company in Pakistan selling medicine in the stringent regulatory markets of Oman and Qatar. Plans are to expand into the UAE. Talking about Pakistan’s National Pharmaceutical export targets, management expressed that the national target of $10 billion or $30 billion is unrealistic for the short term. A target of $3-4 billion by 2030 for the pharmaceutical industry is considered achievable.

Entering new export markets takes significant time around 3 years total, including facility export orientation, approvals, and product registration. The closure of the Afghanistan border is estimated to impact exports by approximately PKR 2 billion for the current fiscal year. This accounts for about 5% of the year’s planned value trajectory, with a gross margin of over 50%. Recovery is possible if the geopolitical situation allows for market recovery within three months.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.