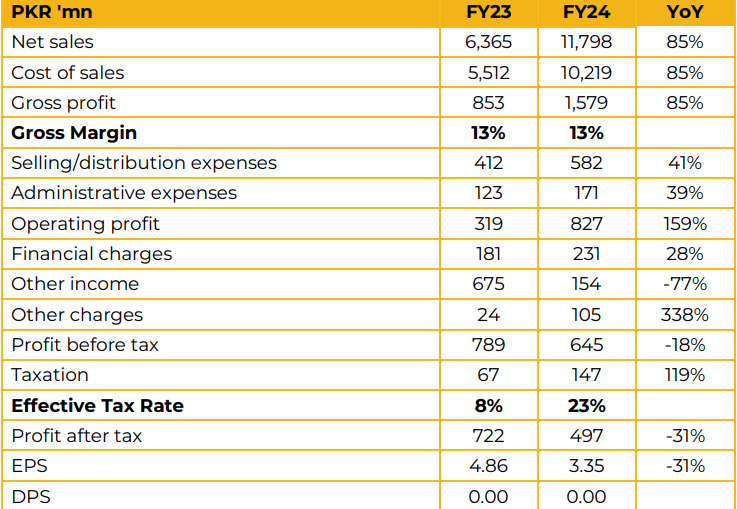

• The Organic Meat Company Limited reported earnings per share of PKR 3.35 in FY24 against PKR4.86 in FY23, a decrease of 31%.

• The company reported a growth of 85% in net sales reaching PKR 11.7 Bn in FY24 against PKR 6.4 Bn in FY23.

• Gross profit was reported at PKR 1.6 Bn in FY24, up 85% from PKR 0.85 Bn in FY23.

• Profit after tax for FY24 was recorded at PKR 0.5 Bn, down 31% compared to PKR 0.7 Bn in FY23.

• The company has recently obtained necessary approvals for the export of pet chews to Canada

• TOMCL has also received approvals for the export of beef casings to the EU and the export of red and white offals to the UAE.

• TOMCL has completed the acquisition of a sheep casing and offal processing facility at Karachi Export Processing Zone and expects to attain control by December 2024

• It is the first company from South Asia to have successfully exported Cooked/Heat treated frozen beef meat products to the Peoples’ Republic of China on March, 2024.

• In September 2024, successfully secured a significant contract for the supply of frozen cooked beef meat to China. This contract was valued at USD 12 Mn and is

expected to be completed inFY25.

• On May 2, 2024, the successful completion of First Phase of Operational Expansion Increases Chilled Product Capacity by 30% at Gadap Facility.

• The company has seen its costs rise due to higher inflation and energy costs. However, the management brought to light that the cost of animals had now stabilized in the domestic market.

• Going forward, the company aims to surpass $50 Mn in export revenue this year. To achieve this the company hopes to begin exports to Italy and to further diversify its product portfolio. It was acknowledged that the UAE market is a large part of its operations but there are efforts being made to grow in other markets as well.

• The management also apprised that the company is in the process of enhancing its supply chain in order to reduce its reliance on market supply and therefore price volatility. It expects all expansions in the future to be carried out using internal cash generation as opposed to debt financing.

• In the future the management expects the following projects to be carried out to enhance revenue and profitability:

1) Dung palletization for fuel efficiency

2) Beef tallow manufacturing

3) Beef (white offal) cooking/heat treatment unit for China

4) Enhancement in red offal processing line for UAE

5) Acquisition of further land for future expansion

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have

a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of

this report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.