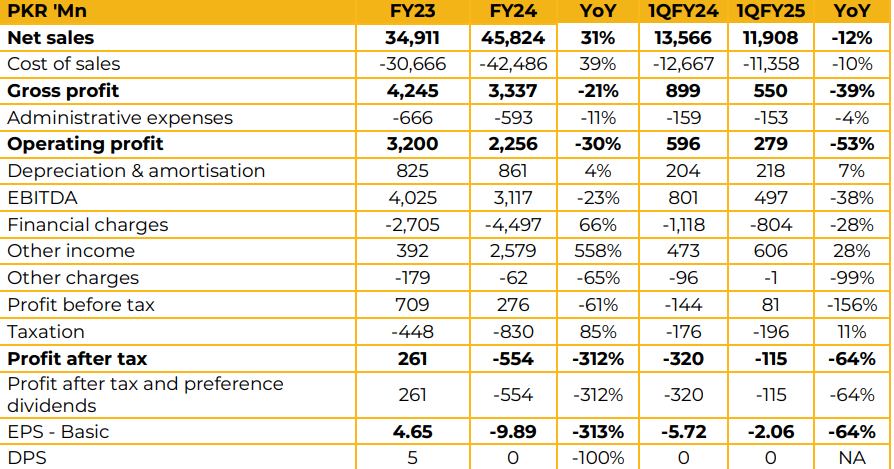

Tata Textile Mills limited reported loss per share of PKR 9.89 in FY24 against a profit per share of PKR PKR 4.65 in FY23. Furthermore, in 1QFY25 the company reported loss per share of PKR 2.06 against PKR 5.72 in SPLY. In terms of financial performance, Tata Textile Mills achieved a significant revenue milestone of 45 billion this year.

However, its gross profit experienced a decline due to rising cotton prices. A notable contributor to the company’s financial performance was other income, which included returns from investments in various securities amounting to 2.5 billion.

Moreover, the company has successfully reduced its inventory days in the current year, which has helped lower finance costs, further strengthening its operational efficiency. Going Forward Tata Textile Mills Limited is strategically focusing on the adoption of cloud technologies and Oracle solutions to drive further automation in its operations. Additionally, the company is prioritizing sustainability initiatives, including the expansion of its renewable energy capabilities. In line with this, Tata Textile Mills is enhancing its green energy infrastructure by adding a 6.6 MW plant by the mid of 2025 to complement its existing 4.4 MW facility, thereby contributing to reduced carbon emissions.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.