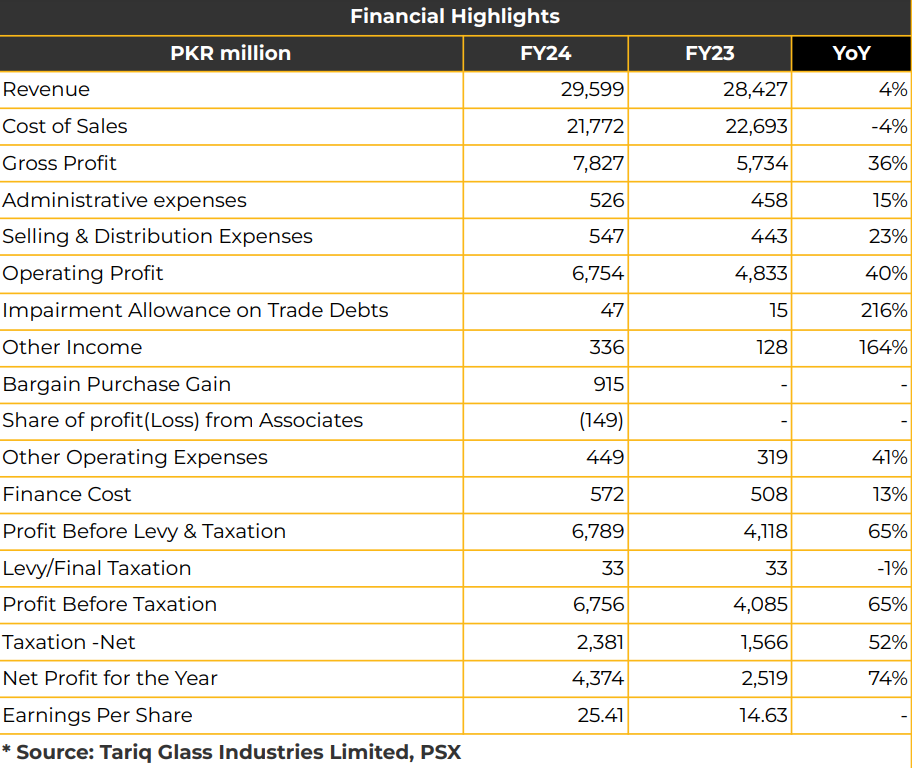

In FY24, Tariq Glass Industries Limited (TGL) posted a net profit of PKR 4.37 billion (EPS: PKR 25.41), reflecting a 74% YoY increase from PKR 2.52 billion (EPS: PKR 14.63) in FY23. Net sales rose by 4% YoY to PKR 29.60 billion, up from PKR 28.43 billion in the previous year. Gross profit surged 36% YoY to PKR 7.83 billion compared to PKR 5.73 billion in the SPLY, while operating profit increased 40% YoY to PKR 6.75 billion from PKR 4.83 billion in FY23. TGL’s geographical sales distribution is 13% in the South, 24% in the North, and 63% in Central Pakistan. Export sales contribute 10% of TGL’s total production, with 37% to Asia, 25% to Europe, 2% to North America, 19% to South America, and 17% to Africa. TGL generated USD 8 million in foreign exchange reserves during FY24. Management reported that exports to neighboring countries are uncompetitive due to higher energy costs. The company’s production capacity is 1,390 tons/day, producing over 15,000 products, including 550 tons of float glass and 200 tons of tableware per day. TGL entered the pharmaceutical glass market in FY24 by acquiring a stake in Baluchistan Glass Limited and commencing operations. TGL also reported that earnings from BGL will be reflected in the next quarter, contingent on gas availability. Moreover, the float glass manufacturing facility project with LCI will be revived as soon as the economic situation improves. Additionally, TGL expanded its solar power capacity by 2.5 MW, bringing the total to 3.5 MW. The company’s energy mix comprises 80% natural gas and furnace oil, with alternative fuels covering the remaining 20%. TGL’s gas requirement is 21 mcf for float glass and 15 mcf for tableware. In FY24, one tableware and float glass plant became operational, and TGL expects two more plants to become operational as the country’s economic conditions improve. Management disclosed that the company is working to reduce its PKR 5.9 billion in piled-up inventories, expecting lower levels as demand picks up in the peak construction season starting in September. Tableware demand is linked to consumer purchasing power, which

is improving as inflation declines. Management reported that TGL partially passed on the impact of inflation to consumers. Receivables stand at PKR 3.3 billion, with trade days at 33 days. Finance costs increased 13% YoY to PKR 572.35 million, up from PKR 508.15 million in FY23. Retained earnings grew 32% YoY to PKR 14 billion, compared to

PKR 10.50 billion last year. Long-term loans declined 39% YoY to PKR 1.2 billion, while short-term borrowing rose significantly to PKR 2.5 billion from PKR 0.92 billion in FY23. TGL holds a 50% market share in the float glass segment, while the total market size is 20-25,000 tons/month for float glass and 6-7,000 tons/month for tableware. The product mix for tableware and float glass fluctuates between 45-55%. The company reported a current ratio of 1.72 and a debt to-equity ratio of 6%. Gross profit margins increased to 26% in FY24 from 20% in FY23, driven by improved operational efficiencies. EBITDA stood at PKR 8.53 billion in FY24. TGL generated PKR 2.25 billion in operating cash flow, down from PKR 3.31 billion in the SPLY, mainly due to increased trade debts and inventory buildup. Investments increased to PKR 2.43 billion from PKR 270 million in FY23. Management stated that TGL is ready to switch to UGDCL and furnace oil generators if the government restricts gas supply to captive power plants. TGL is negotiating with SIFC regarding the smuggling of float glass from Iran, noting a 40-45% price disparity between locally produced and smuggled products. Management indicated that imported products dominate larger retail outlets. The company plans to resume dividend payments after fulfilling working capital needs through internal resources rather than bank borrowings. Going forward, TGL anticipates challenging economic conditions for Pakistan over the next 1-1.5 years. In the export segment, freight and insurance costs remain key obstacles, but management sees potential for growth if these issues are resolved. TGL aims to expand its exports to Eastern, Southern, and Central Asia.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose