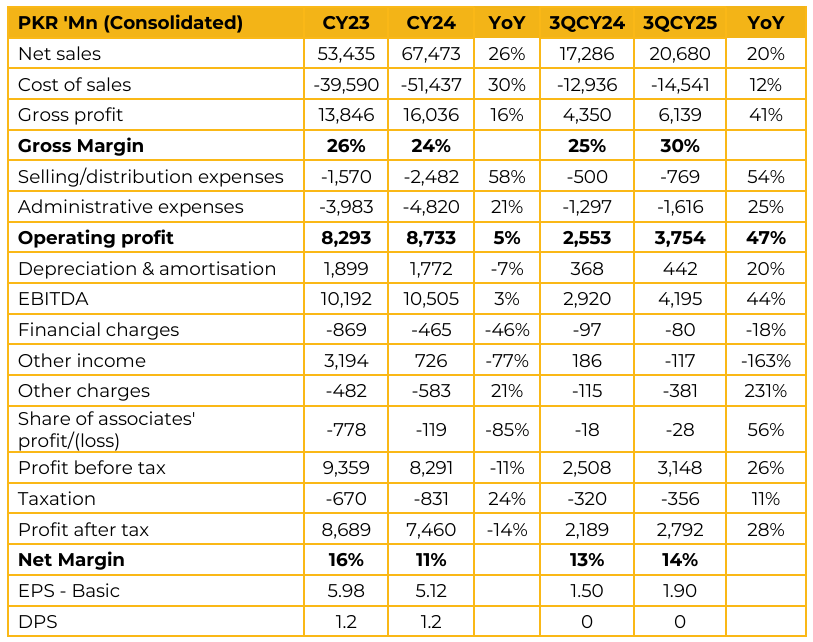

Systems Limited (SYS) reported Consolidated earnings per share of PKR 5.12 for CY24, compared to earnings per share of PKR 5.98 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 1.90, compared to earnings per share of PKR 1.50 in the same period last year (SPLY).

Confiz provides Systems with strategic access to Microsoft, including the US market directly as well as the UK and broader Europe, which management views as important for accelerating growth in these regions. The acquisition creates significant cross sell and upsell opportunities within Confiz existing client base. Confiz has historically been concentrated in the Microsoft ecosystem, which has left SAP, Salesforce, and other enterprise platforms largely to competitors.

Management expects the deal to generate a multiplier effect, primarily by bringing in leadership and capabilities needed to scale. The acquisition is structured as a 100% share swap, with no cash consideration from Systems. Confiz is expected to leave sufficient working capital in the business to support ongoing operations. Confiz is approximately 10% of Systems’ size, broadly in terms of both top-line revenue and profitability.

The implied dilution from the share swap is 4% of Systems’ shares, translating into an estimated 4.0% dilution for existing shareholders (subject to regulatory approvals). Confiz dollar revenue per employee is generally higher than Systems’, reflecting its greater exposure to the US and Europe and a higher proportion of on-site resources. Management noted that persistent inflation and rising salaries continue to pressure margins, despite ongoing optimization initiatives.

Given that 90% of revenue is USD-linked, margins can also come under pressure if the PKR appreciates or remains stable for a prolonged period. The company is actively working to exit loss making contracts and expects the Pakistan domestic business to cease being a loss making unit. The focus is on sustainable growth at higher margins rather than pursuing hypergrowth. The impairment recorded in Q3 relates to expected credit losses (ECL) under IFRS 9 and reflects a conservative provisioning approach. Provisions are recognized when receivable recovery is expected to take more than six months, and management indicated that most amounts provisioned are ultimately recovered.

Management reiterated that it is continuously evaluating M&A opportunities globally and within Pakistan, particularly those that can accelerate expansion in the US and UK. In the Middle East, UAE momentum remains strong. Saudi Arabia saw a rebound in Q4, which is expected to carry into next year as previously delayed public sector investments begin to be released. Overall, the region is showing a healthy uptick.

Blockchain is viewed as a high potential technology, but management noted it has not yet translated into meaningful monetization, as clients are not allocating millions of dollars in budgets at this stage.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.