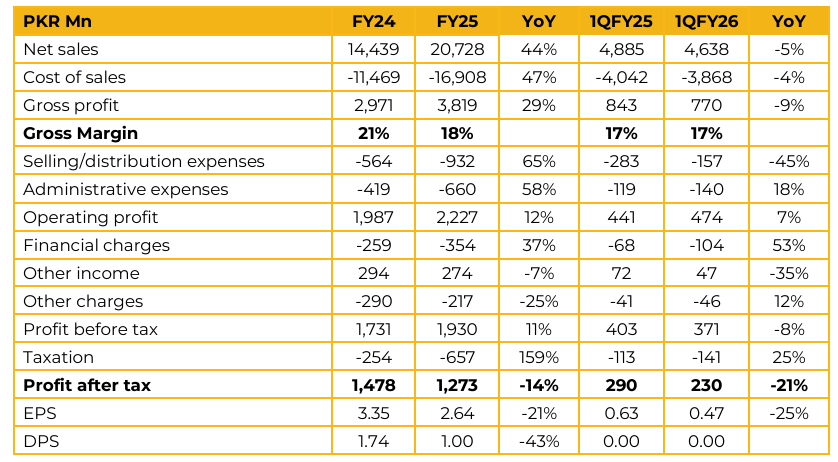

Stylers International Limited recorded earnings per share of PKR 2.64 in FY25, as compared to PKR 3.35 in FY24. The company recorded net sales of PKR 20.7 Bn, up 44% from PKR 14.4 Bn in FY24. During FY25, the company’s gross margin contracted to 18%, compared to 21% in FY24.

Gross profit during the period rose 29% from PKR 3.0 Bn in FY24 to PKR 3.8 Bn in FY25. STYLERS posted profit after tax of PKR 1.3 Bn in FY25, compared to PKR 1.5 Bn in FY24. The company has recently gone through an expansion with Project Sunshine commissioned in FY25.

This project located on a plot of 35 acres with ample space to ramp up production further. As such, management apprised that given infrastructure had already been constructed phase 1 and 2 of the expansion of Project Sunshine in FY26 and FY27 respectively will only require 4 months each.

It was revealed that currently the company’s Glaxo town facility produces 23k pieces a day while Project Sunshine produces 12k pieces a day. Phase 1 and 2 expansions in Project Sunshine will enhance production capacity by 4k pieces a day each, reaching 20k pieces a day. It was highlighted that the purpose of these expansions is to be able to onboard new customers as existing customer mix was relatively concentrated and large customers require capacity of about 12k pieces a day below which it is not feasible to place orders for them.

As a result, by expanding the company reduces its customer concentration risk which right now is high due to one customer contributing about 40% of sales. Project Sunshine is expected to achieve LEED Gold rating with plans to enhance it to LEED Platinum by 2028. This is part of an overall plan for the company to enhance its green manufacturing plan.

Management highlighted that the past year has seen many challenges for the industry with the transition to normal tax regime as well as phasing out of EFS benefits and high energy costs.

Alongside this, it was apprised that Pakistan’s minimum wage is not competitive against regional players like Bangladesh where it is about USD 100 compared to about USD 130 in Pakistan. The company has conveyed these issues to the government through Pakistan Textile Council in the hope that action could be taken to alleviate the industry’s problems. Going forward, the management was hopeful of an improvement in margins to FY24 levels as Project Sunshine ramps up production and initial teething issues are resolved.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.