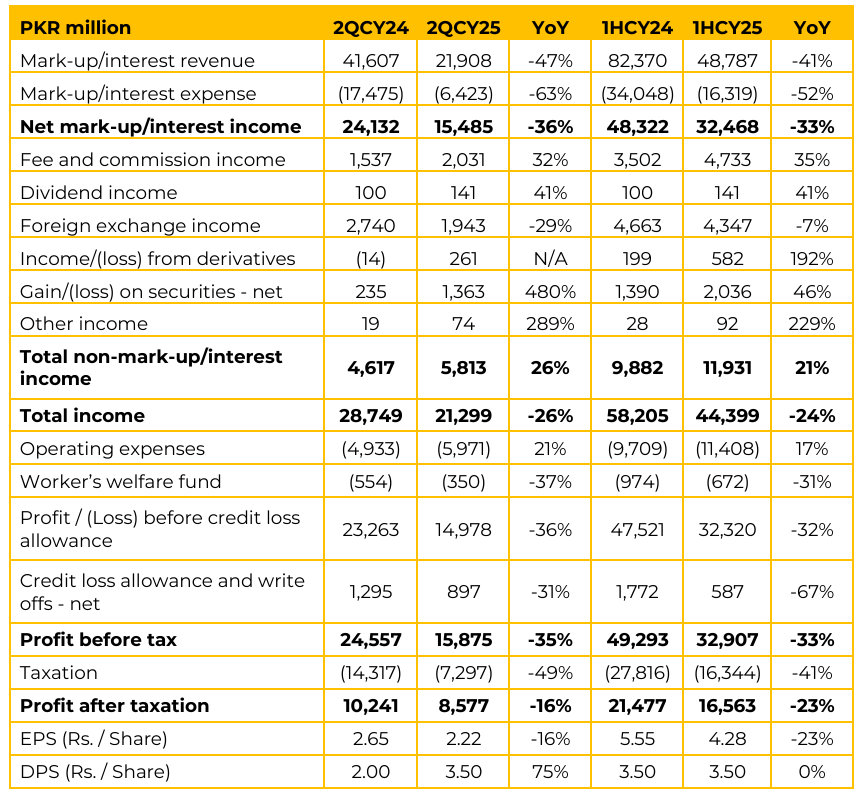

SCBPL reported a noticeable decline in topline, largely driven by the sharp reduction in domestic interest rates. For 1HCY25, the net interest income (NII) fell by 33% YoY to PKR 32.5 billion, reflecting the 41% YoY drop in mark-up revenue. However, non-funded income (NFI) offset part of this pressure, rising 21% YoY to PKR 11.9 billion, supported by fee growth, gains on securities, and derivatives income.

Overall, total income contracted by 24% YoY to PKR 44.4 billion. Operating expenses increased 17% YoY, though the cost-to income ratio at 27.2% still remains one of the lowest in the industry (second-best after Meezan Bank). Profit before tax fell 33% YoY to PKR 32.9 billion, while profit after tax declined 23% to PKR 16.6 billion. Return on equity moderated to 28.8% (43.8% in 1HCY24), but remains one of the highest among peers.

EPS came in at Rs 4.28 vs. Rs 5.55 SPLY, and the bank declared an interim dividend of Rs 3.5/share, maintaining its consistent payout policy. The bank’s balance sheet contracted by 11% since December 2024 to PKR 944 billion, largely due to a 17% drop in deposits to PKR 697 billion. The management noted that the bank shed expensive, low-margin savings deposits to optimize its funding base.

The idea was to protect margins and align with the bank’s “returns-not size” strategy. As a result, the mix improved in favor of current accounts, making up 59% of deposits, while CASA overall remained high at 97% With one of the lowest Advance-Deposit ratios in the industry 30.2%, the bank plans to deploy excess liquidity more actively into the economy rather than parking it predominantly in government securities.

The bank signaled an explicit commitment to support agriculture, SMEs, and middle-market financing, aligning with government priorities. On the corporate side, the bank is positioning itself to participate in large projects (e.g., Reko Diq, mineral and mining initiatives) and multilateral/government financing opportunities.

On the retail side, growth will be driven by affluent banking and digitization. Management noted over 90% of transactions are already digital, and branch optimization will continue, guided by customer voice and usage patterns. Islamic advances now make up roughly 30% of the loan book, with management indicating a “directional journey” towards further expanding the Saadiq franchise.

Going forward, the management emphasized that most of the adverse impact of monetary easing has already flowed through earnings, particularly in Q2. They do not expect significant further rate cuts ahead, which should help stabilize margins and profitability in coming quarters.

This provides a clearer earnings visibility versus the sharp contraction seen in H1. Management expressed that while the recent floods displaced ~2.5 million people and may cause a $2–3bn hit to the economy, driving food and commodity inflation alongside fiscal and external account slippages. Despite these headwinds, the $7bn IMF program, rollovers and inflows from multilaterals are anchoring stability, while FDI prospects linked to SOE restructuring and growth in minerals, IT, and agriculture offer upside. Monetary easing is expected to improve private sector credit demand.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.