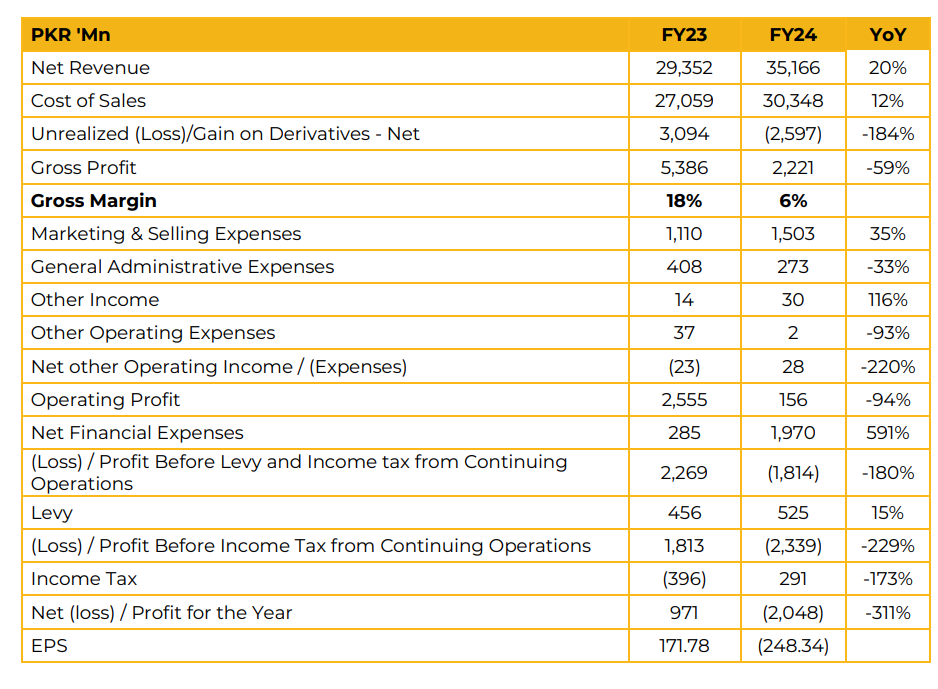

In FY24, Siemens (Pakistan) Engineering reported a net loss of PKR 2.05 billion (LPS: PKR 248.34), compared to a net profit of PKR 970.84 million (EPS: PKR 171.78) in the previous year.

The decline in profitability was primarily driven by an unrealized loss of PKR 2.6 billion on foreign currency derivatives and finance costs of PKR 2 billion related to energy projects. Revenue from the Smart Infrastructure segment grew by 107% year-on-year to PKR 8.9 billion in FY24, up from PKR 4.3 billion in the SPLY.

Management attributed this growth to energy conservation initiatives, the rehabilitation of electrical distribution networks, channel partner augmentation, and a refinery upgrade project with PARCO. However, the segment’s growth was impacted by geopolitical tensions and reduced public sector PSDP investments. The Digital Industries segment recorded a 72% YoY increase in revenue, reaching PKR 3.1 billion in FY24 compared to PKR 1.8 billion in the SPLY.

This growth was driven by securing couple of cybersecurity projects from local customers and various energy-related initiatives. The Energy business, carved out in December 2024, reported a modest growth of 4% YoY, with revenue increasing to PKR 25.5 billion from PKR 24.4 billion in the previous year.

Siemens (Pakistan) energized the KKI 500/220kV Grid Station during the year and signed a contract to automate 27 barrages and a command center for the Indus Basin Irrigation System in Islamabad. This project is expected to serve water management and control in the country.

The company also completed the installation of new switchgears at PARCO to enhance power system control and monitoring.

Additionally, Siemens provided technical services for electrical systems installation, testing, and commissioning to clients in the Middle East. The company reported an order book of PKR 26 billion as of FY24.

Going forward, management plans to focus on delivering technology-driven solutions, supported by a solid order book. However, they highlighted key challenges, including ongoing brain drain, limited public-private sector investments, and persistent political instability in the country

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.