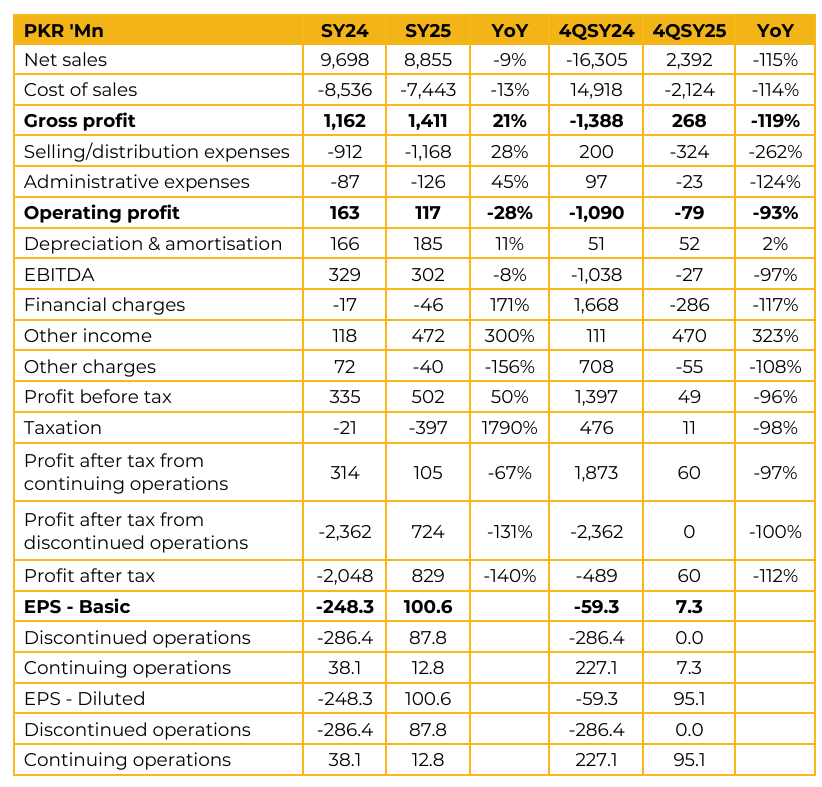

Siemens (Pakistan) engineering (SIEM) reported earnings per share of PKR 100.6 for SY25, compared to loss per share of PKR 248.3 in SY24. Furthermore, in 4QSY25, the company reported earnings per share of PKR 7.3, compared to loss per share of PKR 59.3 in the same period last year (SPLY).

The Smart Infrastructure segment manages electrical products for low and medium voltage applications, grid software for distribution companies, and building management systems. Management highlighted that the carve out of the Siemens Energy portfolio became effective on 31 December 2024. The Digital Industries vertical focuses on factory and process automation, motion control solutions, and engineering software.

To expand market reach particularly across the low voltage and Digital Industries portfolios the company has onboarded approximately 20 business partners. The company secured meaningful orders for water treatment plants and distribution networks in Northern Pakistan.

A key milestone was the telemetry project covering 27 barrages. The company is actively engaging with utilities such as GEPCO, while also evaluating future opportunities with LESCO and FESCO. Continuing operations contributed approximately PKR 8.5 billion of total revenue, with the remainder attributable to the first three months of the Energy portfolio prior to its separation. Overall, the strategy is to leverage Siemens global domain expertise and collaboration, while utilising its local manufacturing footprint to expand market share.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.