Key Takeaways:

• The Shifa National Hospital Faisalabad (SNHF) – Phase 1, a PKR 5.1 billion equity-funded project, is set to operationalize by 2026.

• Management is evaluating alternative options to optimize its value instead of selling Shifa Medical Center Islamabad (SMCI).

• Management plans to drive future revenue growth through expansion into new specialties, regional outreach, and enhanced operational efficiencies.

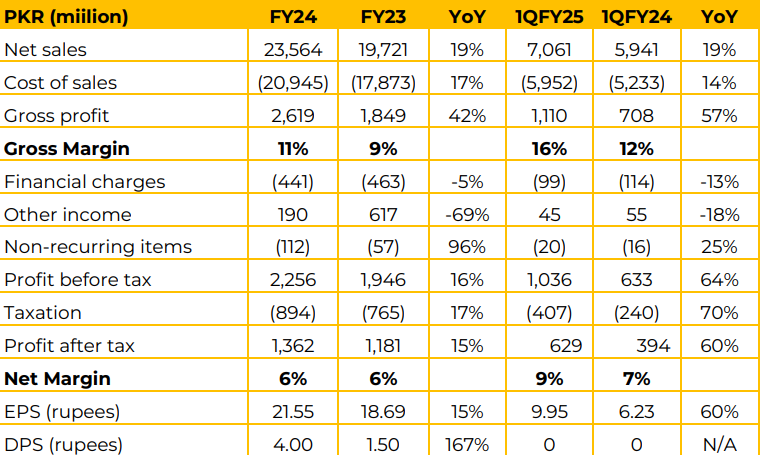

Shifa International Hospitals Limited (SHIFA) reported net sales of PKR 23,564 million in FY24, reflecting a solid 19% YoY growth compared to PKR 19,721 million in FY23.

This momentum continued in 1QFY25, with revenue increasing by 19% YoY to PKR 7,061 million, driven by robust patient volumes and enhanced service offerings. . Consequently, profit after tax (PAT) climbed 15% YoY to PKR 1,362 million in FY24 and 60% YoY to PKR 629 million in 1QFY25.

The net margin remained steady at 6% in FY24 but improved to 9% in 1QFY25 from 7% in the same quarter last year. .. The first phase of the Shifa National Hospital Faisalabad (SNHF) (127 beds) project is progressing, with plans to operationalize outpatient and inpatient facilities by 2026. This initiative is set to establish a new benchmark in healthcare services for Faisalabad and its surrounding regions, supporting the hospital’s vision of extending premium healthcare to underserved areas.

According to the management, the total CAPEX on the SHNF is around PKR 5.1 billion, out of which Shifa has incurred PKR 1.5 billion and futher PKR 1.6 billion remains to be incurred by Shifa. Whereas, Interloop has invested PKR 1.1 billion as of now, and further PKR 1.6 billion remains to be invested by Interloop.

The project is entirely funded through equity. The project is expected to breakeven in the fourth year of its operations. With regards to Shifa Medical Center Islamabad (Pvt.) Limited (SMCI), the construction of the hospital building remained at halt. The sponsors initially contemplated divesting their investment in the SMCI and reallocating it to another related project, SNHF.

However, given the current economic conditions, the real estate market has significantly plummeted. Accordingly, the Board of directors of SMCI in the recently held meeting has instructed its management to evaluate various feasible options other than the sale.

Going forward, management anticipates revenue growth and improved gross margins, supported by plans to expand facilities and specialties, enhance operational efficiencies, and hire specialized consultants. With regards to significant cash reserves, the management noted that they are utilized in further expansions into specialities to stay ahead of the curve.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose