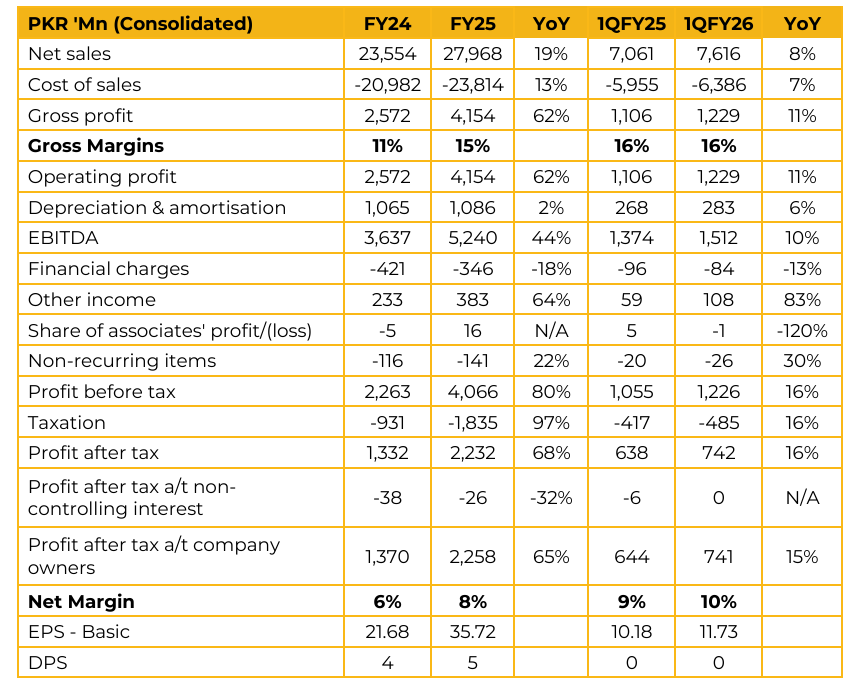

Shifa International Hospitals Limited (SHFA) reported consolidated earnings per share of PKR 35.72 for FY25, compared to earnings per share of PKR 21.68 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 11.73, compared to earnings per share of PKR 10.18 in the SPLY. CAPEX for the year was PKR 2.7bn, sharply higher than PKR 795mn last year, reflecting an accelerated investment phase. Historically, price increases have averaged around 7–10%, and management broadly expects this trend to continue, with additional growth coming from new projects such as Faisalabad and F-11. Near term, gross margins will be dampened by the gestation period of new hospitals, which initially run at a loss, but management sees steady net margins normalizing in the 5–7% range.

The Faisalabad hospital remains on track, with the grey structure completed and a total project CAPEX of roughly PKR 6.7bn. The facility is sizeable, with a grey structure of about 375,000 sq. ft., of which Phase 1 will utilize around 125,000 sq. ft. It is expected to be operational from the 4QFY26. Management expects the project to break even in Year 3, turn profitable from Year 4, and ultimately add about 7–8% to the current topline, implying a payback period of roughly ten years.

The SMCI share acquisition is largely complete and the company is now working through the merger process, although no firm timeline has been disclosed and management highlights that it will take time. E-Shifa (SHD) acquisition has been completed. This platform is focused on economical, at-home healthcare services, and the group is exploring partnerships, including with IFC, to scale the model while maintaining quality standards. At the existing H-8 campus in Islamabad, critical care beds are running at 100% utilization, highlighting strong demand and SIHL’s positioning as a regional leader in high-acuity care. Management plans to re-purpose certain areas and enhance capacity, particularly in critical care.

Overall bed occupancy is around 65%, which management views as healthy, and the average length of stay is a relatively low 2.7–2.9 days, indicating efficient throughput despite the complexity of quaternary care services.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.