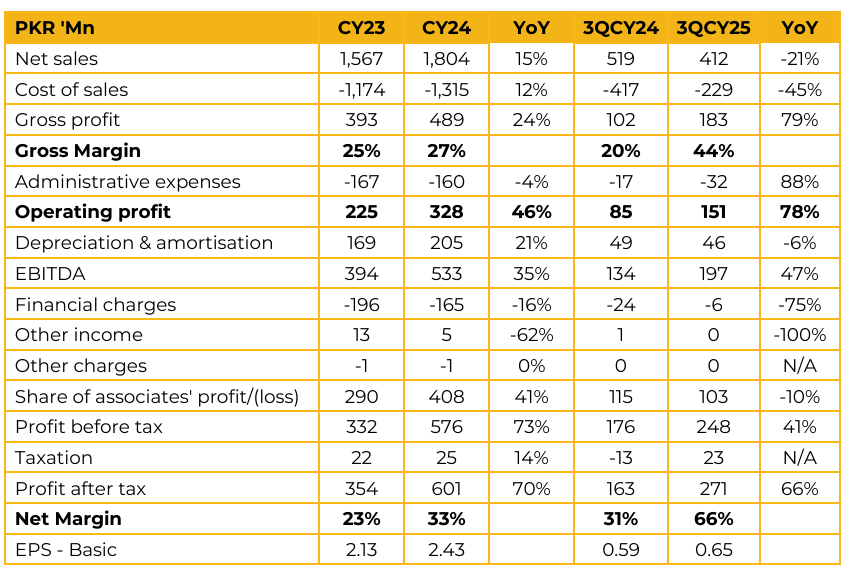

Secure Logistics-Trax Group Limited (SLGL) reported earnings per share of PKR 2.43 for CY24, compared to earnings per share of PKR 2.13 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 0.65, compared to earnings per share of PKR 0.59 in the same period last year (SPLY). Trax is experiencing significant volume growth, with daily deliveries increasing from 20,000 in mid-2025 to 42,000–45,000 currently. Management has set an ambitious target of reaching 100,000 daily deliveries by end of CY26. The company currently operates 170–180 commercial vehicles and plans to expand the fleet to 284+ vehicles by end-2026.

Notably, Trax is piloting Electric Vehicles (EVs) in Karachi for last mile delivery, with expected annual fuel cost savings of approximately PKR 100 mn. Management also plans to expand its fleet mix, targeting 160 medium haul vehicles and 386 last mile vehicles by CY30 to support growing operational demand. SLG Trax holds TIR certification for cross border operations. Although the Afghanistan border closure remains a near term challenge, management has finalized partnerships in Uzbekistan and Kazakhstan and is prepared to resume cross border operations once borders reopen. Through its subsidiary Logiserve and the Finova software platform, the group is scaling its NBFC operations.

A pilot program has already financed 1.2 million shipments, with full scale digital lending expected to launch by March/April 2026, targeting a PAT of PKR 266 million. Currently operating three warehouses, the group plans to upgrade existing facilities with auto-sorting technology and temperature-controlled units, with a long-term goal of expanding to 10 warehouses by 2029. Integration initiatives have resulted in approximately PKR 300 million in annual savings, primarily through office consolidation and HR optimization.

Management has provided segment wise forecasts of Net Income for CY26, with the E-commerce (Trax) business expected to generate PKR 508 million, followed by Logiserve (NBFC) at PKR 266 million. The Logistics (SLG) segment is projected to contribute PKR 370 million, while the Security (FSL & LG) segment is expected to deliver PKR 117 million.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.