Key Takeaways:

• Company enjoys monopoly in key products; Pink & Red dyes and optical brightener

• Newly installed Solar project to reduce 70% of the electricity cost • Customers are intact, despite the imposition of advance tax

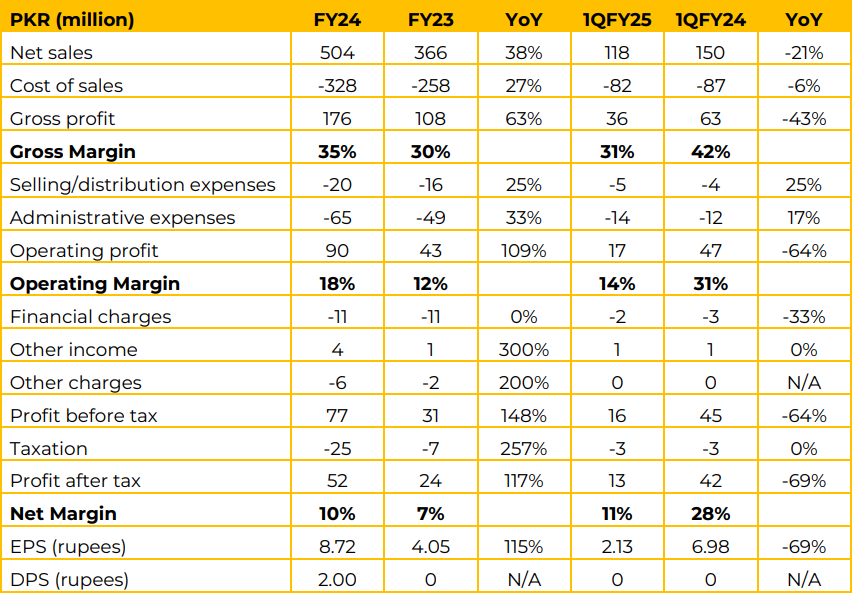

The company reported a 38% year-on-year (YoY) growth in net sales for FY24, reaching PKR 504 million compared to PKR 366 million in FY23.

However, in 1QFY25, net sales dropped 21% YoY to PKR 118 million from PKR 150 million in 1QFY24. The company attributes the decline in sales to increase in sales tax rate up to 18%, which resulted in higher selling prices and lower sales. Moreover, the imposition of advance tax on sales to distributors, dealers and wholesalers has led the wholesalers to directly import their goods instead of purchasing from the local manufacturers, thereby impacting the company sales.

However, the management highlighted that their core customers are intact and the reduction in sales was a psychological impact of the newly imposed taxes. EPS for FY24 doubled to PKR 8.72 from PKR 4.05 in FY23, reflecting strong bottom-line growth.

A cash dividend per share (DPS) of PKR 2.00 was declared for FY24, compared to no dividend in FY23. However, the quarterly EPS for 1QFY25 plunged 69% YoY to PKR 2.13.

The company enjoys monopoly in some of its products including Red & Pink dyes and optical brightener. Moreover, the solar project of 421 KWP has started generating electricity and management believes that it will reduce 70% of the electricity cost, which they were initially consuming from WAPDA.

Going forward, the management is optimistic about the Company’s future, emphasizing the importance of exchange rate stability for the industry. The focus will remain on delivering high-quality products and cost controls to maintain market share and drive growth.

The management also highlighted that the directors of the company surrendered their dividends in favor of the public shareholders.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.