Key Takeaways:

• Management anticipates finance cost to reduce, in-line with declining interest rates.

• Company is expanding its Solar capacity to reduce energy cost; Current 8% of energy mix (Target 20%)

• Company is expected to shift to grid from gas power plant; no major difference in prices of grid & gas – Management believes.

• Export competitiveness of Textile sector to remain under pressure amid stable rupee dollar parity

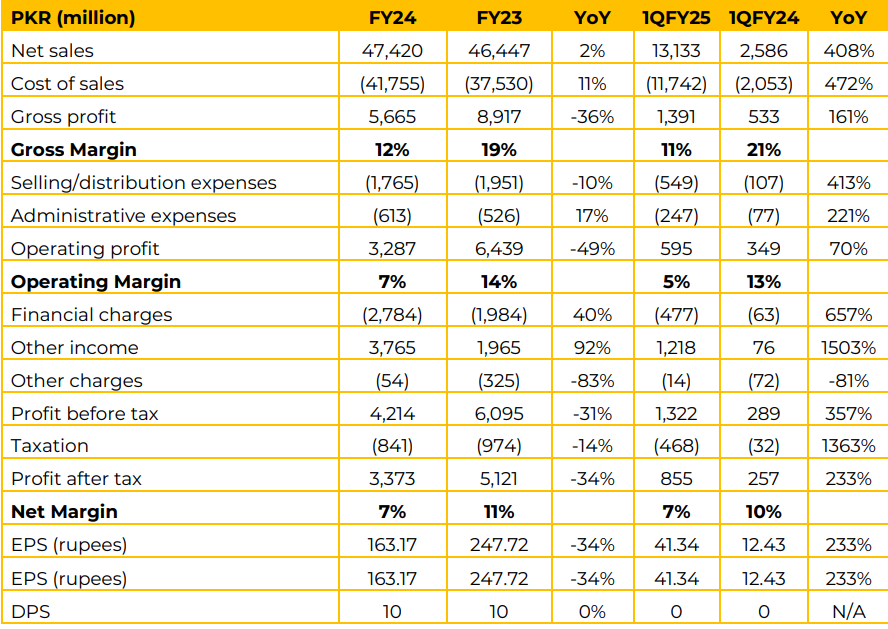

Sapphire Fibres Limited reported a marginal 2% year-onyear (YoY) increase in net sales for FY24, reaching PKR 47,420 million compared to PKR 46,447 million in FY23.

However, 1QFY25 showed an extraordinary growth of 408% YoY, with net sales surging to PKR 13,133 million from PKR 2,586 million in 1QFY24.

Financial charges rose significantly by 40% YoY in FY24 to PKR 2,784 million due to higher interest rates or increased borrowing. The impact was more pronounced in 1QFY25, where financial charges surged by 657% YoY to PKR 477 million.

However, management believes that recent rate cuts will have a favorable impact for the company. Other income saw a remarkable increase of 92% YoY in FY24, reaching PKR 3,765 million, mainly from the investments made in capital market by the company.

Moreover, a major portion of this income is also supported by its power generation company “Sapphire Electric Limited”, which contributed PKR 1.7 billion in FY24.. The management highlighted that they try to source cheaper yarn, either from other sources or locally from its spinning unit.

Company exports knit directly. However, in denim fabric they also sell it to other stitching units. The company mentioned that their order book is quite improved now for knits. On the power side, the current power mix comprises 8% of solar, 88%-92% gas power plant and rest from grid.

However, company’s objective is to increase the solar share to 20% in the long-run. The company would also shift on grid, if gas supply is halted. The management believes that there is no major difference between the grid and the gas power plant, therefore there would be no unfavorable impact on the cost side.

Going forward, there’s cautious optimism about the improvement in the textile sector, however no major change expected. In the short-run due to lower profitability the impact of Normal tax regime has not been material, however as profitability increases, the impact will be highlighted. The company will keep on investing in its subsidiaries to diversify its income. Dividends from Sapphire Electric are expected to remain stable.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.