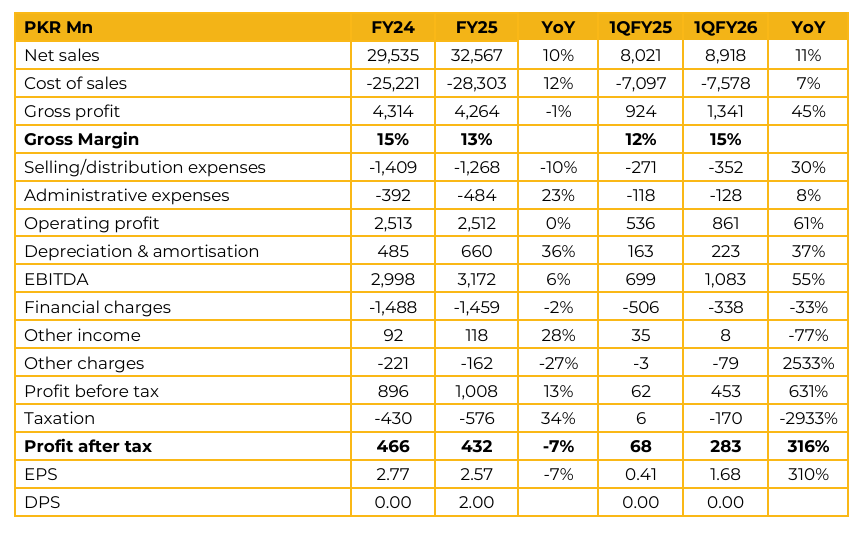

Panther Tyres Limited recorded earnings per share of PKR 2.57 in FY25, as compared to PKR 2.77 in FY24. The company recorded net sales of PKR 32.6 Bn, in line with PKR 29.5 Bn in FY24. During FY25, the company’s gross margin contracted to 13%, compared to 15% in FY24. Along with this, it saw its gross profit decrease 1% from PKR 4.31 Bn in FY24 to PKR 4.26 Bn in FY25. PTL posted profit after tax of PKR 432 Mn in FY25, compared to PKR 466 Mn in FY24.

The company management highlighted that over the past their margins have been around the 14-15% mark whereas deviations to the downside have been rare. In the recent past, rubber prices had experienced a spike which caused a dip below 14%. Now that rubber prices have fallen, it apprised that it expects margins to return to historical levels of 14-15% and remain sustainable. With regards to the closure of trade with Afghanistan the management revealed that about 2-4% of their sales are to Afghanistan which have been impacted.

On the other hand, the closure of Afghan transit trade has reduced the volume of smuggled imports providing growth in local market sales. The company is currently operating at about 80% utilization. The management noted that its recent expansion was heavier on intermediate and back-end processes providing ample runway for the next 5-10 years. The company’s back-end processes are operating at a 40% utilization.

PTL has also taken steps to diversify its raw material sources to be able to procure good quality at a good price. Management revealed that Pakistan’s tyre market has a growth rate of about 10% while the company’s topline has been growing at 15% due to export sales growth. It highlighted that while margins are initially near 5-6% when trying to penetrate a new market after 3-4 years it rises to about 10%.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.