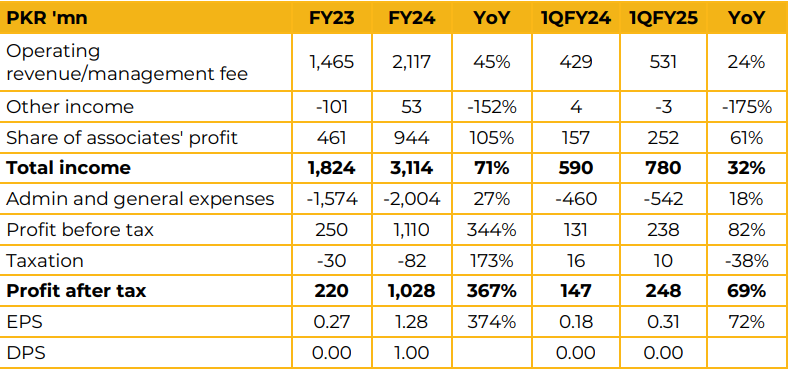

Pakistan Stock Exchange Limited reported earnings per share of PKR 1.28 in FY24 against a earnings per share of PKR 0.27 in FY23, depicting an increase of 374%.

Furthermore, in 1QFY25 the company reported earnings per share of PKR 0.31 against PKR 0.18 in SPLY. PSX has seen a rise in trading activity in recent times as Average Daily Traded Value rose from PKR 10.1 Bn in FY23 to PKR 22.7 Bn in FY24 and finally to PKR 26.4 Bn in 1QFY25. As a result, revenues have risen and provided significant growth to profitability. Similarly, the exchange saw a rise in listing activity with 10 debt listings and 5 equity listings in FY23 rising to 15 debt listings and 12 equity listings in FY24.

This trend is continuing with 3 debt and 2 equity listings in the first quarter of FY25. The management informed that pending SECP approval the company plans to carve out its building and land assets totaling over PKR 4.5 Bn into a REIT.

The company is also working to include banks on its exchange so that a vibrant secondary market for sukuks and tbills can be created. In this regard, management informed that work is ongoing and could take up to 18 months. Management also explained how PSX, NCCPL and CDC were all separate entities due to regulations.

However, it noted that SECP had asked them to look into how some functions of these companies can be merged to prevent duplication of processes and to increase efficiency, The management also apprised that it had the necessary infrastructure to offer options as a product however the major hurdle is that there is no participant willing to take on the role of market maker.

The company has also recently carried out an awareness session in Lahore to attract more listings at the exchange.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.