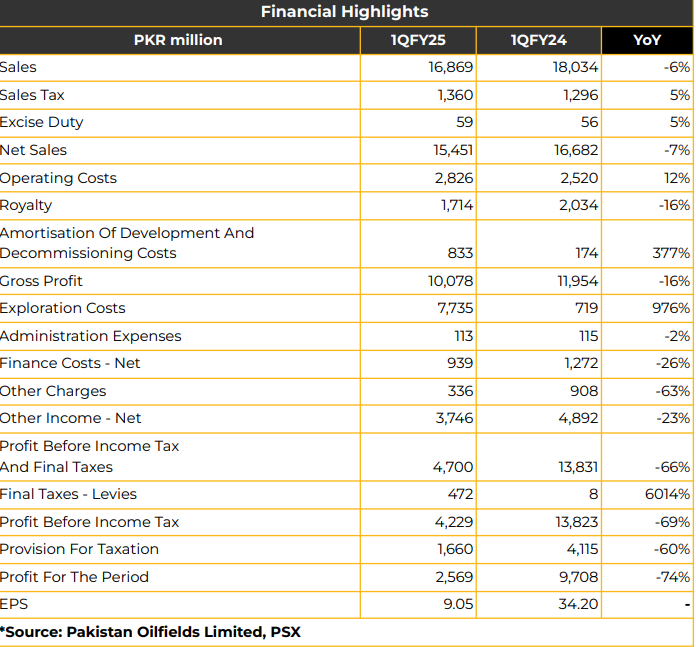

In 1QFY25, Pakistan Oilfields Limited reported net earnings of PKR 2.57 billion (EPS: PKR 9.05), reflecting a 74% YoY decline from PKR 9.71 billion (EPS: PKR 34.20) in the SPLY.

The decline in profitability was attributed to the charging of Rs 7.66 billion related to the drilling and testing costs following unsuccessful results. The company’s revenue decreased by 7% YoY to PKR 15.45 billion, with gross profit down by 16%, totaling PKR 10.08 billion.

Operating expenses rose 12% YoY to PKR 2.83 billion, while exploration costs significantly surged to PKR 7.74 billion in 1QCY25 compared to PKR 719.19 million in the SPLY. Finance costs decreased by 26% YoY to PKR 939.33 million in 1QCY25, compared to PKR 1.27 billion in the SPLY.

Other income dropped 23% YoY to PKR 3.75 billion in 1QCY25 from PKR 4.89 billion in the SPLY. In FY24, POL achieved a net profit of PKR 39.15 billion in FY24, 7% YoY up due to price increases, from 36.45 billion in the SPLY. Net sales also witnessed a growth of 7% YoY to PKR 65.29 billion in FY24 while cost of goods increased by 4% YoY to PKR 19.90 billion in FY24. Exploration costs and other expenses declined by 76% YoY and 43% YoY to PKR 1.61 billion and PKR 7.12 billion, respectively, in FY24. In FY24, crude oil production declined by 5% YoY to PKR 1.73 million barrels while gas production declined by 50% YoY to 22.55 million MMscf in FY24. LPG production declined by 5% YoY to PKR 50.28 metric tons in FY24. At the Tal block’s Razgir-1 exploratory well, initial testing produced 20 MMscf of gas and 250 bpd of condensate. Subsequent testing of the Kawagarh formation increased output to 22.46 MMcfd of gas and 220 bpd of condensate. Management expects the Razgir-1 exploratory well to commence production in April 2025.

After testing the Lockhart formation of the Razgir-1 well, production reached 17.9 MMscf of gas and 153 bpd of condensate. Plans are underway to complete the well for optimal production, with pipeline preparations in progress to connect it to the facility.

Additionally, 3D seismic data interpretation for Makori, Makori Deep, Billitang, and Kot South has been completed, while analysis on Kahi North, Sarozai, Sarozai Deep, Manzalai South, and Manzalai Deep is ongoing. At Hisal block, 3D seismic acquisition covering 235 square kilometers has been completed, with data processing underway. At Gurgalot block, 3D seismic data interpretation has concluded, and the subsurface location of Gurgalot X-1 has been finalized, with well planning in progress. In the Ikhlas block, POL began drilling the Jhandial-03 well reaching 17,778 feet to assess hydrocarbons.

This well has started production of 700 bpd of oil while the 4th well is under evaluation. Meanwhile, the Balkassar Deep-1A well encountered various issues and ultimately did not yield successful results. At the Pindori Lease, POL has completed a 3D seismic acquisition project covering 60 square kilometers, with data processing underway. At the Tal block, the Makori Deep-3 well has been approved, and well site preparation is currently in progress.

Meanwhile, the Adhi South-05 well is now producing approximately 200 bpd of oil. Management reported a liability of PKR 31 billion as of June 30, 2024, related to enhanced gas reserves in the Tal block. The case remains pending in the high court.

The Adhi South-6 well successfully reached its target depth and is currently producing 550 bpd of oil. The Adhi South-8 well was drilled to a depth of 11,353 feet, with drilling operations completed.

The well was successfully put into production, yielding 475 bpd of oil and 0.45 MMcfd of gas. The Adhi South-9 well has reached its target depth, and well testing is currently underway. At the Ratana Development and Production Lease, operated by Orient Petroleum Limited, the Ratana-5A well has been approved by the Joint Venture Partners.

Going forward, management expects receivables from SNGPL to remain fully recoverable. POL aims to maintain its current payout ratio, subject to board approval, and does not anticipate any dry wells in the near future. Capex for exploration and development is projected at PKR 8-10 billion for FY25, down from PKR 12 billion in FY24. Management anticipates arresting natural decline in production with the help of Razgir-I exploratory well.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.