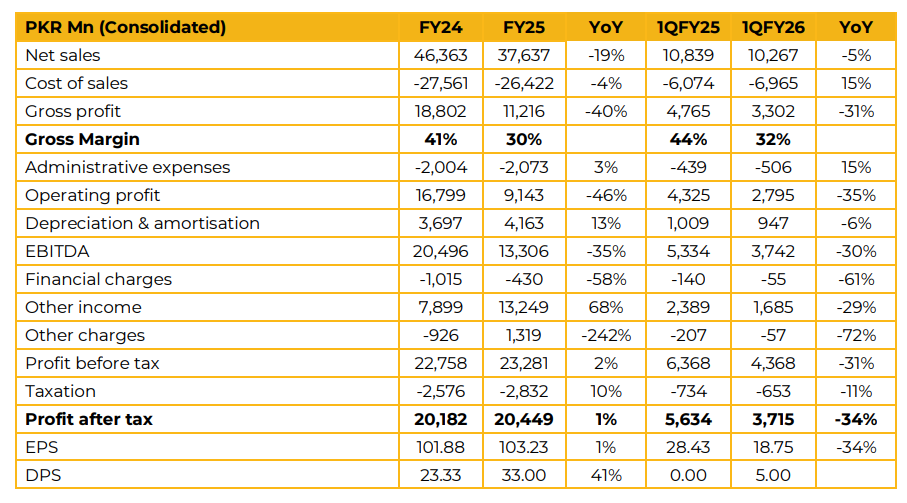

Pakistan National Shipping Corporation recorded consolidated earnings per share of PKR 103.23 in FY25, as compared to PKR 101.88 in FY24. The company recorded net sales of PKR 37.6 Bn, down 19% from PKR 46.4 Bn in FY24. During FY25, the company’s gross margin contracted from 41% in FY24 to 30%. As a result, it saw its gross profit decrease 40% from PKR 18.8 Bn in FY24 to PKR 11.2 Bn in FY25.

PNSC posted profit after tax of PKR 20.4 Bn in FY25, compared to PKR 20.2 Bn in FY24. The company recently had its independent procurement policy approved by the government which allows it to procure new and used vessels. As a result, it is beginning a phase of expansion by utilizing its cash and short-term investments of over PKR 67 Bn. Its fleet currently numbers 10 ships (5 tankers and 5 bulk carriers) with plans to acquire 3 more in 2025 and 12 more by the end of FY26. Of these new vessels to be ordered in 2025, 2 are Aframax class tankers with tier 3 engines and an age of about 3.5 years. The 3rd is a MR2 tanker with an age of about 5 years.

All 3 are expected to be delivered in January 2026. The total cost of three vessels stands at about 193 Mn USD. The payments will be made with 20% equity and 80% locally denominated debt; the company has already paid a 25% down payment and expects to obtain approval from SBP for the purchase of remaining dollars from the interbank market to pay the remaining balance.

The company hopes to achieve a target average ROCE of 20%+ on all its newly acquired ships moving forward. As a result, these new ships are expected to contribute greatly to the profitability of the company due to their higher efficiency. For the 12 vessels the company plans to buy in FY26, it was apprised that some will be chartered and some will be outright purchased. The exact plan for these ships would become clearer once it is decided whether the letter of intents from Port Qasim Authority and Karachi Port Trust will yield business agreements.

With regards to the imposition of sales tax on ship imports, the management clarified that it was also applicable to them. They believe that under the Sales Tax Act Section 6 they should be allowed to pay the same in instalments and as such were hopeful that approval would be granted to ease cash flow requirements. It was also highlighted that the shipping policy exempts ship purchases from sales tax which is in conflict with the sales tax imposition.

Management also highlighted that it is more cost effective in operating expenses than global benchmarks providing it with a distinct competitive edge. This edge in operating expenditure encompasses lower, manning, insurance, stores and spares, lubricants, repair and maintenance, dry docking and management and administrative costs. This edge is present in the segments of bulk carriers, LR1 tankers and Aframax tankers. Alongside this, it was also highlighted that PNSC has a superior net profit margin, return on equity and return on assets for FY24 compared to the shipping corporations of Bangladesh, India, Singapore and Malaysia.

With regards to shipping rates, the management apprised that liquid cargo rates are trending downwards with paper for the next quarter signalling a further drop expected. Dry bulk rates are steady at this time. Both these rates remain uncertain in the future due to ongoing developments in the Ukraine war and the Red Sea which can cause a material change at any time if conflict flare up or simmer down.

Management highlighted that it sometimes receives less than ideal rates from clients as its vessels cannot dock in some jurisdictions such as India and South Africa. With regards to taxation, the company clarified that it only pays income tax at the regular rate on markup income and other such segments. For the hauling of goods, it pays USD 1 per Ton on all goods shipped in an owned vessel. For chartered vessels, the rate is 20 cents per ton for the first 5 voyages after which the rate is USD 1 per Ton.

In response to a question regarding dividend policy, the management apprised that it does not want to disappoint shareholders, however due to ongoing expansion plans only excess cash which is not needed to finance growth will be paid out in the near future. Moving forward, management was hopeful for the future with regards to both demand in the global market as well as in the local market. It highlighted that most of Pakistan uses C&F shipping while increased awareness would shift usage to FOB which will provide ample growth runway for the company

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.