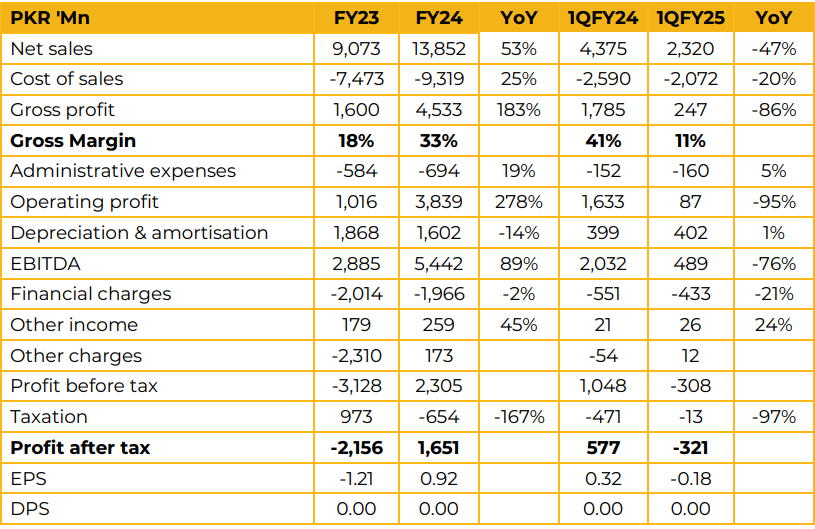

Pakistan International Bulk Terminal Limited reported earnings per share of PKR 0.92 in FY24 against a loss per share of PKR 1.21 in FY23.

Furthermore, in 1QFY25 the company reported loss per share of PKR 0.18 against earnings per share of PKR 0.32 in SPLY. The management apprised participants that the Reko Diq project is expected to go live in 2028 and as such they would not go into details regarding this deal at this point in time.

The company’s management believes that it should see revenues recovering as the economy continues to stabilize and imports recover along with industrial activity.

It was also clarified that the company cannot give dividends due to covenants in loans from foreign creditors such as IFC. As such, it believes dividends can be started once the amount of about $16 Mn is paid off to these creditors. The terminal’s capacity for handling of coal is 12 million tons per annum.

The lease for the port is for 30 years till 2046 and can be further extended 30 more years. Management was hopeful that a recovery in cement demand and exports will provide an opportunity to grow revenue.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose