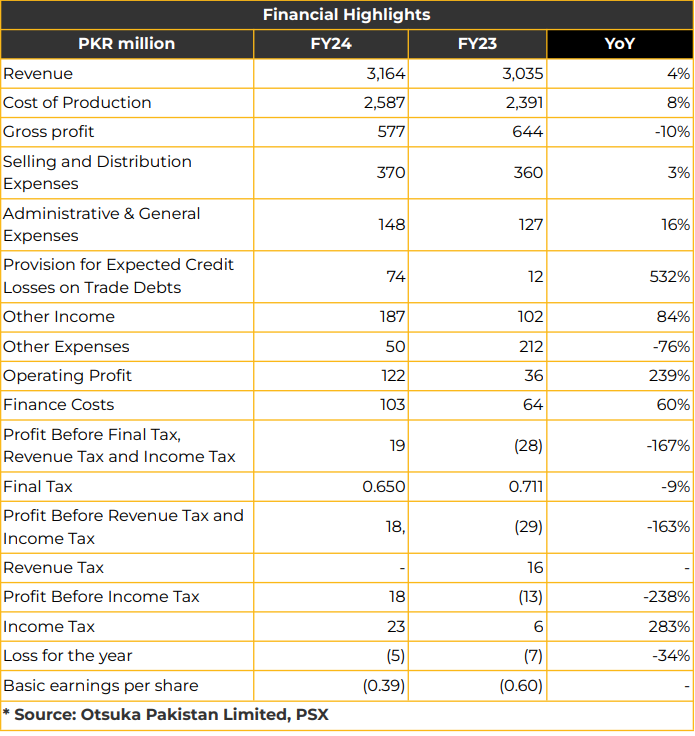

In FY24, OTSU reported a loss of PKR 4.8 million (LPS: PKR 0.39), reflecting a 34% improvement from the previous year’s loss of PKR 7.21 million (LPS: PKR 0.60).

During this period, gross profit declined by 10%, while operating profit rose substantially to PKR 121.78 million in FY24 from PKR 35.87 million in the SPLY.

Net sales increased modestly by 4%, reaching PKR 3.16 billion, despite an 8% rise in the cost of sales, which totalled PKR 2.59 billion.

Gross profit margins dropped to 18% in FY24 (from 21% in FY23) due to higher costs, while operating and net profit margins improved to 4% (1% in FY23) and 1% (from a 16% loss in FY23), respectively. Segment-wise, OTSU saw diverse performance across sales channels: IV sales surged by 51%, followed by CN at 40%, MD at 3%, and TD at 6%. OTSU’s products follow a seasonal inventory trend, with stock levels rising in January, February, and March before declining in subsequent months.

However, OTSU plans to further reduce its inventory levels. Efforts to rationalize the IV business and strategize CN sales led to a 200% increase in CN sales in September, with this growth continuing into October 2024.

Changing distributors improved margins and cash flow in the southern region, including Karachi. Management plans to expand the clinical nutrition segment by introducing new high-margin, value-added products such as Fatolip, Kidmin, and Amiparen. Previously, Kidmin was imported from the group company. With registration received for Fatolip, a 1QFY25 launch is planned, alongside significant promotional efforts due to its high-margin potential.

The company noted a 7% increase in regulated products and endorsed the de-regulation of non-essential products. A hardship-based request to DRAP has been submitted for price increases on nine products, particularly IV solutions, to address escalating production and operational costs.

OTSU also introduced new products, ORTEie in FY23 and Alpha Berry in FY24, with positive market reception. The breakup value was reported at PKR 55.80 per share.

OTSU operates five production lines: Line I for CN products and 100 mL, Line II for IV Solutions 1000 mL, Line III for small-volume ampules, and Line IV for nutrition products.

Management reported that the dividend was not announced due to margin compression and liquidity issues. However, the Company plans to give a final dividend of 20-22% in FY25. Management anticipates ongoing economic challenges, including high inflation, rising utility costs, global oil prices, and exchange rate fluctuations.

Plans include a PKR 100 million CAPEX renovation of Line I and a gradual increase in nutritional product sales through new investments.

The company’s strategic focus remains on clinical nutrition and nutraceuticals with upcoming launches of new value-added products

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From

time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws,

have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject to this report Chase Securities as a firm may have business relationships, including investment

banking relationships with the companies referred to in this report This report is provided only for the

information of professional advisers who are expected to make their own investment decisions without

undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or

indirect consequential loss arising from any use of this report or its contents At the same time, it should

be noted that investments in capital markets are also subject to market risks This report may not be

reproduced, distributed or published by any recipient for any purpose.