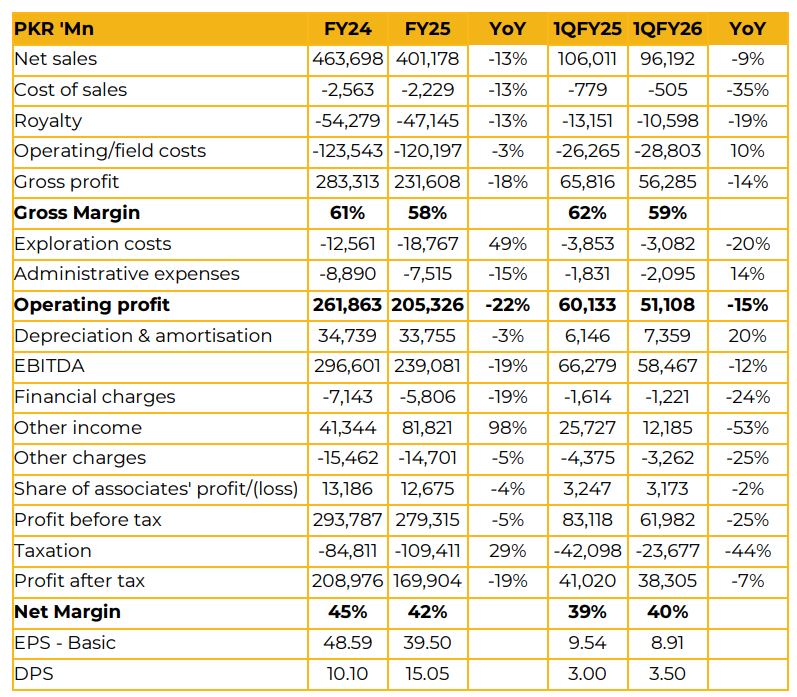

Oil & Gas development Company Limited (OGDC) reported earnings per share of PKR 39.50 for FY25, compared to earnings per share of PKR 48.59 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 8.91, compared to earnings per share of PKR 9.54 in the same period last year (SPLY).

During the period, OGDCL reported five new discoveries: Chak 202, Soghri North-1, Baloch-2, Faakhir-1, and Bettani-2. As of June 30, 2025, the company holds 118 MMBBL of oil out of the country’s 240 MMBBL total reserves and 5,790 BCF of gas out of national reserves of 18,981 BCF, representing approximately one-third of Pakistan’s hydrocarbon base. Management highlighted significant production curtailment during the period due to persistent line-pressure issues, which resulted in 1,790 barrels of oil, 91 MMCF of gas, and 72 tons of LPG being curtailed.

However, with expected delays in international RLNG cargo arrivals and based on global supply outlook, OGDCL anticipates that these curtailment constraints should begin to ease by April–May. Gas from the Shiva field is currently being injected into the system, with gross gas injection of 67 MMCF. At the Bettani field, three wells have been completed and are ready for system injection; however, due to law-and-order challenges and line-pressure issues, the third well could not be brought fully online as expected, resulting in line losses linked to security constraints. The field’s current production potential is estimated at 33–34 MMCF of gas.

Management noted that as the law-and-order situation improves, and with additional development planned over the next 3–5 years, the field’s long-term potential is projected to reach 70–100 MMCF. OGDCL retains an 8.33% stake in the Reko Diq project through Pakistan Minerals Development Company Limited and other entities. Phase 1 production is expected to commence in 2028, after which Phase 1 cash flows will be allocated toward Phase 2 development. The first dividend is anticipated in 2031–2032, with OGDCL’s share estimated at USD 150–200 million. The company continues to undertake seismic and exploration activities in geologically challenging regions, particularly in Balochistan and Khyber Pakhtunkhwa, reinforcing its long-term growth pipeline

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.