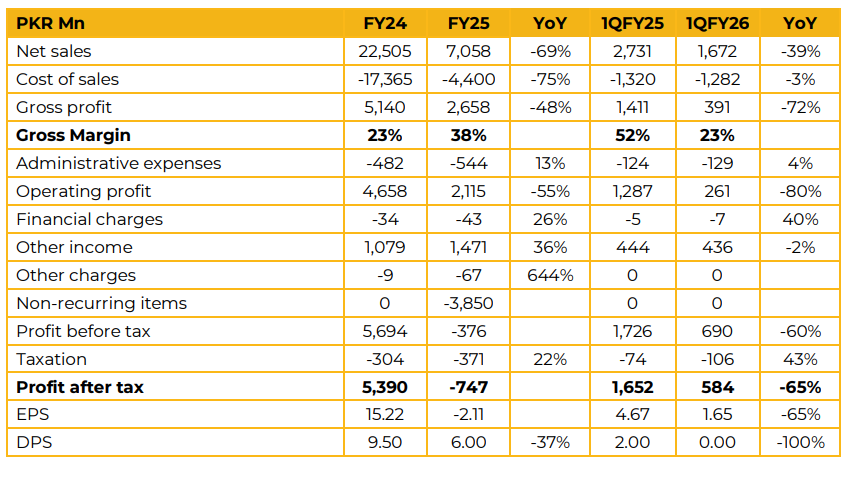

Nishat Power Limited recorded loss per share of PKR 2.11 in FY25, as compared to earnings of PKR 15.22 in FY24. The company recorded net sales of PKR 7.1 Bn, down 69% from PKR 22.5 Bn in FY24. During FY25, the company’s gross margin rose from 23% in FY24 to 38%.

Along with this, it saw its gross profit fall from PKR 5.1 Bn in FY24 to PKR 2.7 Bn in FY25. NPL posted loss after tax of PKR 747 Mn in FY25, compared to a profit of PKR 5.4 Bn in FY24. This loss was primarily due to one-time adjustments relating to negotiations held with the government on a revised power purchase agreement.

The company has converted its tariff to a hybrid Take and Pay model where its ROEDC has been structured with a 35% fixed component and a 65% variable component. Along with this the insurance premium for FY26 inwards has been capped at 0.9% of the EPC.

The terms of international arbitration have also been removed and any dispute with the power purchaser will also have to be dealt with through local arbitration. With regards to its subsidiary NexGen Auto Private Limited, the company management apprised that over 2,000 units of the Jaecoo J7 have been booked so far. NPL owns a 33% stake in this entity. The CKD plant is now operational and deliveries of vehicles are expected to begin from mid-December.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.