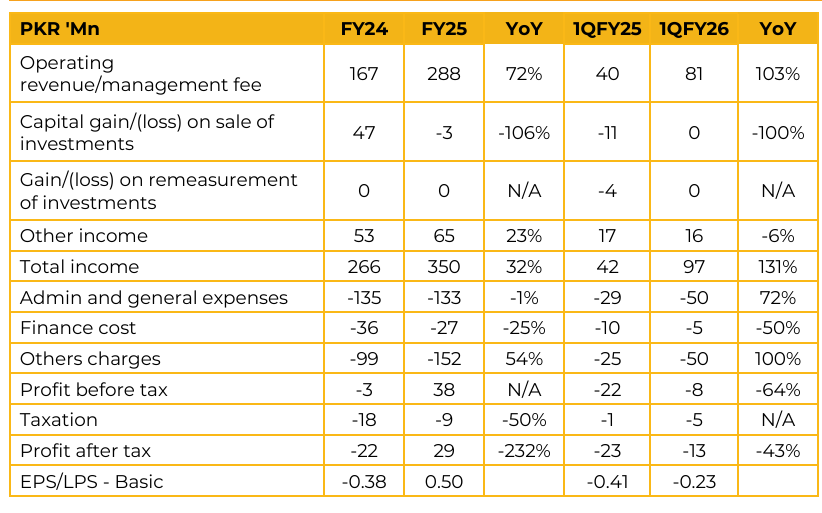

Next Capital Limited (NEXT) reported earnings per share of PKR 0.50 for FY25, compared to loss per share of PKR 0.38 in FY24. Furthermore, in 1QFY26, the company reported loss per share of PKR 0.23, compared to loss per share of PKR 0.41 in the same period last year (SPLY).

Investment banking revenues remain “lumpy,” as they depend on the closure of transactions that often span six to twelve months or longer, while associated costs are recognized quarterly, creating timing mismatches in reported earnings. The company has onboarded more than 8,000 clients to date, with a steadily rising trend in new account openings.

The user base is young, with an average age of 31, and 83% of clients are first time investors, reflecting strong penetration among new market participants. Next Capital’s brokerage income grew by 96.85% to PKR 238.4 million, driven by higher trading flows and significantly increased activity in both regular and futures markets. Advisory and related income also increased to PKR 92.25 million, compared to PKR 67.07 million in the previous year.

The company acted as Manager to the Offer for Maple Leaf Cement in its acquisition of Agritech and is currently advising Maple Leaf on its proposed acquisition of Pioneer Cement. In the debt capital markets, Next Capital executed several transactions, successfully closing sukuk issuances for Sitara Chemical Industries Ltd. and Burj Clean Energy Modaraba. Additionally, the company won the Financial Advisor mandate for the privatization of Zarai Taraqiati Bank Ltd. (ZTBL) after a competitive selection process involving six consortiums, further strengthening its investment banking credentials.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.