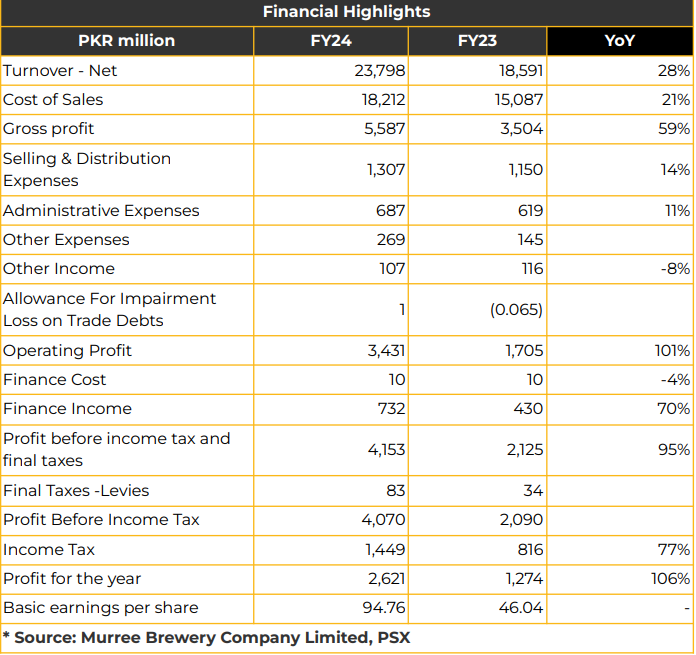

In FY24, MUREB reported a significant turnaround in net profit, reaching PKR 2.62 billion (EPS: PKR 94.76), up from PKR 1.27 billion (EPS: PKR 46.04) in the previous year.

Revenue increased by 28% YoY, totalling PKR 23.80 billion in FY24, compared to PKR 18.59 billion in the SPLY. Gross profit rose by 59% YoY to PKR 5.59 billion, while operating profit grew by 101% YoY to PKR 3.43 billion. Cost of sales increased by 21% YoY to PKR 18.21 billion.

Selling and distribution expenses rose 14% YoY to PKR 1.31 billion, and administrative expenses increased by 11% YoY to PKR 687.19 million. However, finance costs declined by 4% YoY to PKR 9.89 billion. The increase in margins within the liquor division was attributed to reduced costs and volumetric growth. In FY24, MUREB consumed 504 million tons of barley and 12,000 tons of sugar in raw materials for alcoholic products, with barley primarily imported from Australia and China.

The company uses a mix of local and imported materials, typically holding stock to last a year but management maintained a 3-4 month supply due to fluctuations in currency in FY24. The total raw material cost was reported at PKR 14 billion.

The Company has a silo capacity of 630 million tons for controlled storage, alongside a fully automated grain handling system for smooth transport to the malt house. MUREB’s annual production capacity is supported by an on-grid solar system of 120 KW. MUREB expects its new PET production line to become operational before the upcoming season, which will add 42,000 cases to its daily capacity, meeting the rising demand for non-alcoholic products. Additionally, the Company plans to install a new ammonia screw compressor synchronized with its existing compressor to enhance refrigeration efficiency and reduce energy costs.

In FY24, MUREB expanded its glass melting capacity by 16%, from 122 TPD to 130 TPD. Civil work on the project is complete, and furnace block shipments are in transit from suppliers in China. The project, with a capex of PKR 1.5-2 billion, is expected to be completed by September 2025. Management reported that the company also sells glass products to third parties.

A new bottled drinking water filling line was added, with a capacity of 24,000 bottles per hour. The plant’s production capacity now stands at 20 tons per hour. MUREB also added a 2-litre juice line with a 2,000 bottle-per-hour capacity in the Tops Tetra Pak Hatter.

Management noted several challenges, including super tax, unpredictable taxes and duties, rising utility costs, reliance on Punjab Excise for price setting, supply chain disruptions, fluctuating currency and the impact of the parallel market. Going forward, MUREB expects gradual improvement but anticipates ongoing challenges with energy prices, inflation, security issues, and currency stability.

The Company aims to expand exports to non-Muslim countries, pending regulatory approvals from Punjab Excise.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly

subject to this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.