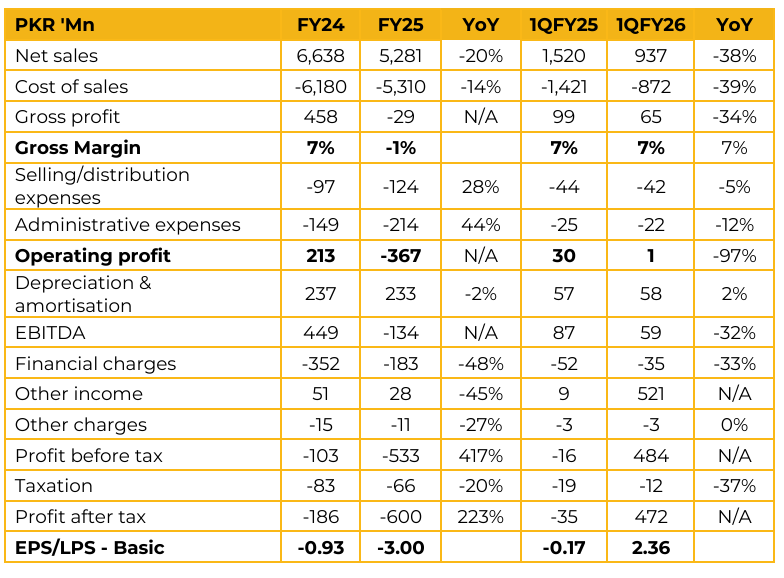

Merit Packaging Limited (MERIT) reported loss per share of PKR 3.00 for FY25, compared to loss per share of PKR 0.93 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 2.36, compared to loss per share of PKR 0.17 in the same period last year (SPLY). The Offset Division currently features high end printing machinery, along with efficient pre press, cutting, and high speed equipment. It has a stated capacity of more than 900 metric tonnes. Management attributed the high loss to a considerable decline in customer orders during 4QFY25.

However, the company has reported an improvement in sales orders in the recent quarter. The primary goal for the current year is to achieve a positive bottom line. The key strategy is to strengthen and expand the Offset Division. Management is also focused on controlling internal waste and operational leakages to enhance margins. Global and geopolitical conflicts are expected to increase international and local raw material prices.

The packaging industry remains highly competitive, leading to consistently thin margins. A significant competitive challenge stems from the widespread undocumented economy, where players operating outside the tax net are able to offer highly competitive prices.

The documented market size for quality packaging board is estimated at approximately 300,000 tonnes, including production from Century Paper Packages Limited and limited imported bleached board. When accounting for smaller undocumented players, the total market size is reasonably estimated to be slightly below 500,000 tonnes. The main raw material used is paperboard, nearly 100% of which is procured from Century Paper. While imported boards are also available, they often present quality concerns.

Most imported boards are stock lots sold by traders, which lack consistent quality. The company uses tailor made board to ensure consistent print quality. The division currently has a capacity to produce more than 900 MT per month. Potential output could reach 1,200 MT if production were limited to heavier 350 GSM board, although actual output varies based on customer requirements, which range from 215 GSM to 350 GSM.

The company has commenced machinery maintenance, with one unit completed and another underway. Once both are fully operational, output is expected to rise above the current 900 tonne level.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.