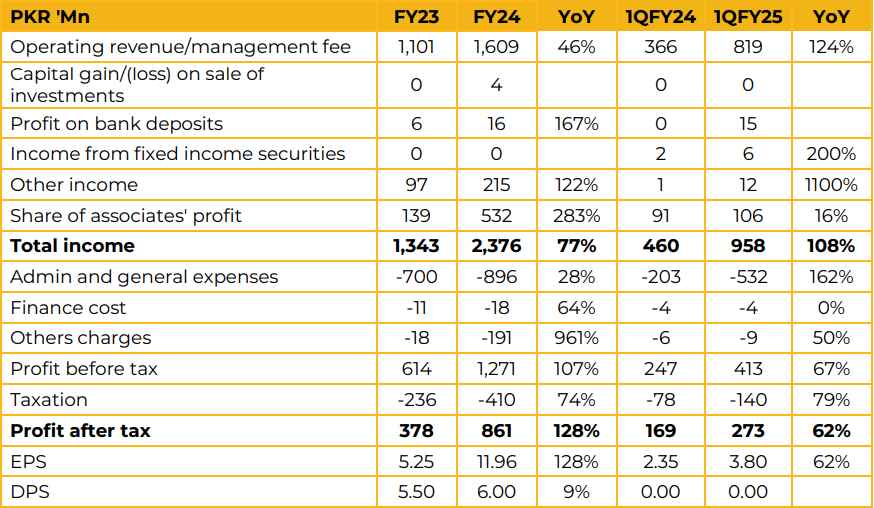

MCB Investment Management Limited reported earnings per share of PKR 11.96 in FY24 against PKR 5.25 in FY23, an increase of 128%.

Total income in FY24 was recorded at PKR 2.38 Bn, up 77% from PKR 1.34 Bn in FY23. MCBIM is currently pursuing licenses for REIT management and private fund management services.

While these initiatives are not expecting to provide significant upside in the near future the company is hopeful that over time they will contribute to profitability. The company has also worked to increase its customer base by focusing on digital initiatives such as integrating the MCB Live app, introducing biometric verisys and eliminating the need for physical forms.

The management highlighted that at the end of FY23 assets under management were PKR 226 Bn which reached PKR 326 Bn by the end of FY24.

The company has also put in significant effort into fine tuning its approach to investors by analyzing their marketing efforts and by analyzing the data of its existing customers. Using this it expects to be able to improve its efforts to gain more investors.

Management also highlighted that it was able to generate profit from investment of PKR 571 Mn in the back of its equity investments. Going forward, they expect this strategy to continue albeit with a less aggressive approach. They were of the belief that equity markets will continue to perform against a backdrop of fiscal consolidation with opportunities also being available in money markets due to a declining interest rate environment.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.