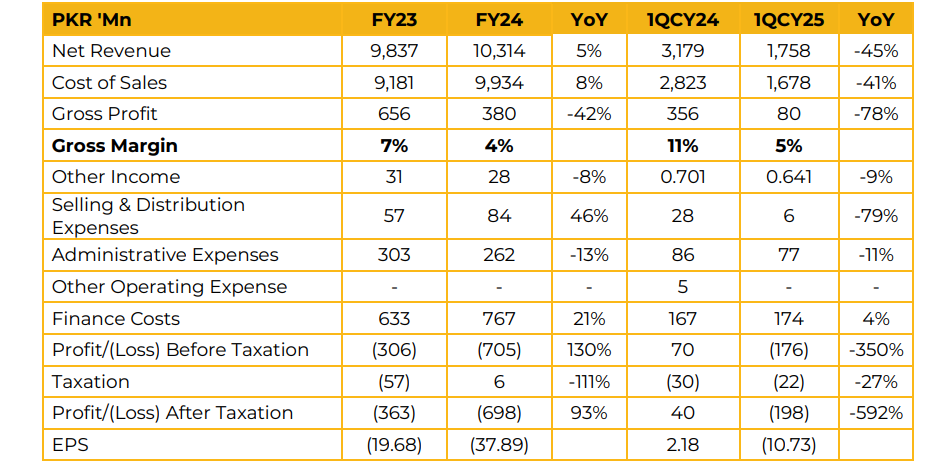

Maqbool Textile Mills Limited (MQTM) reported a net loss of PKR 698.42 million (LPS: PKR 37.89) for FY24, widening from a net loss of PKR 362.73 million (LPS: PKR 19.68) in FY23.

Revenue for FY24 increased by 5% year-on-year to PKR 10.31 billion. Management highlighted a rise in local demand as many textile companies have ceased operations due to high energy costs and markup rates.

The company’s energy mix comprises 90% reliance on MEPCO and FESCO, with the remaining 10% sourced from solar energy. In October 2024, MQTM commissioned a 3.5MW solar plant at a cost of PKR 325 million, addressing part of its 7.9MW energy requirement.

Additionally, the company is working to secure a gas connection to further reduce energy costs. Export activity has been at a standstill for the past few months. However, MQTM has started receiving export inquiries from Bangladesh, China, and Korea and expects to secure new orders early next year.

Looking ahead, the company plans to optimize costs, maximize capacity utilization, refine its sales mix, and focus on value-added segments to improve margins and operational synergies

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.