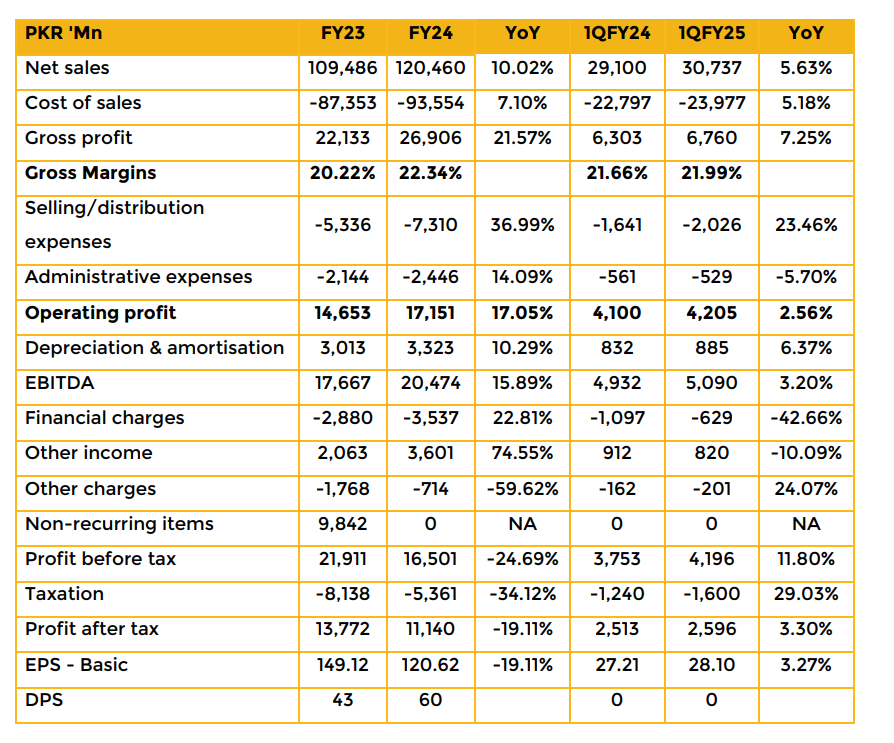

Lucky Core Industries Limited reported earnings per share (EPS) of PKR 120.62 in FY24, compared to PKR 149.12 in FY23. In 1QFY25, the company posted an EPS of PKR 28.10, slightly higher than PKR 27.21 in the same period last year. The polyester and pharmaceutical segments performed well during the year, driving improved operating performance. In the soda ash segment, both local and export volumes remained subdued.

Export pricing faced challenges due to increased product availability from China. In the polyester segment, the key driver of profitability growth was higher international freight costs, which led to an increase in product prices. On September 6th, the company completed the acquisition of Pfizer’s portfolio, contributing PKR 3.2 billion in revenue by the year-end. Management expects this portfolio to generate approximately PKR 8-9 billion in revenue next year. In China, soda ash demand declined due to reduced glass manufacturing for solar applications, negatively impacting product prices. Management anticipates continued weakness in this segment.

Within the pharmaceutical sector, 65% of the portfolio consists of non-essential products, while 35% comprises essential drugs. However, nearly all Pfizer products fall under the essential category.

The company plans to install a new boiler by year-end, offering flexibility to use biomass, local coal, and imported coal, which will enhance power efficiency. Management does not foresee any major capital expenditure (Capex) requirements for the current year. The boiler project is 50% complete and is expected to be finalized within the year. Going forward, management expects strong performance in the pharmaceutical and polyester segments.

They also intend to maintain their dividend payout policy. Additionally, the company is setting up a veterinary facility in Sheikhupura. The soda ash expansion is currently in the design phase, which will take approximately one year, after which management will decide on the next steps.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.