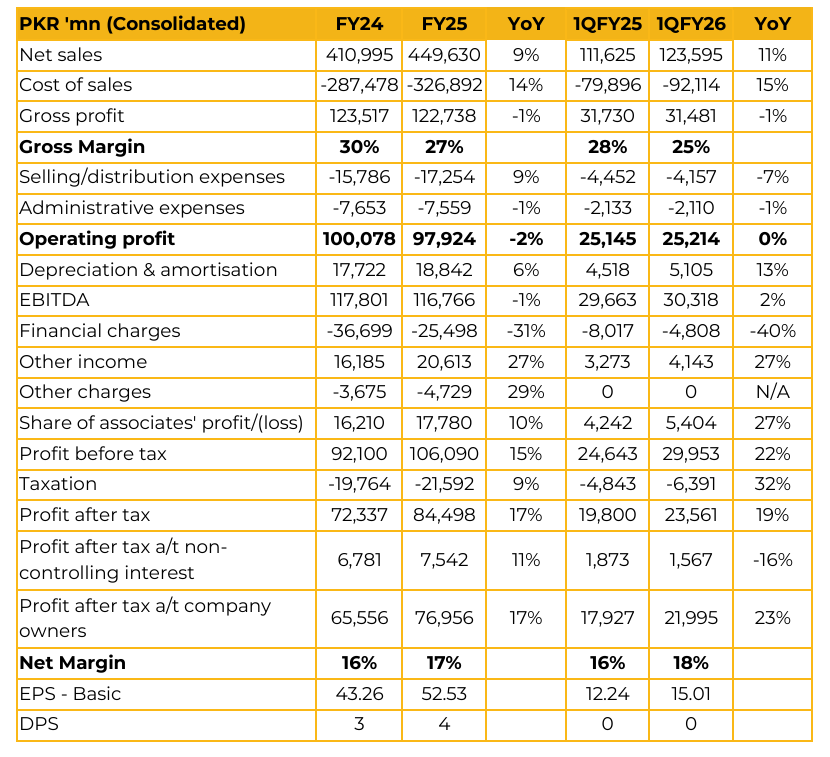

Lucky Cement Limited (LUCK) reported consolidated earnings per share of PKR 52.53 for FY25, compared to earnings per share of PKR 43.26 in FY24.

Furthermore, in 1QFY26, the company reported earnings per share of PKR 15.01, compared to earnings per share of PKR 12.24 in the same period last year (SPLY). The average retention price is approximately PKR 15,200 ton. The company’s average coal cost is around PKR 34,000 ton, with the company shifting heavily toward international coal due to the unavailability of Afghan coal and elevated local coal prices.

In Iraq (Samawa), the company has opened a new 65 million ton cement grinding mill, which commenced commercial operations in November 2025. Africa remains the company’s primary export destination, with new markets including the USA and Brazil. Regarding Lucky Motors, management remains confident in its ability to compete through brand strength, supported by Pakistan’s largest dealership network.

However, no specific details were shared regarding any potential new Chinese vehicle partnerships.. Given high levies, furnace oil is no longer a viable option. The company is utilizing the government’s new power incentive package, with a weighted average electricity cost of approximately PKR 32.5/unit.

Management views recent consolidation in the cement industry positively, noting it should deliver synergies and enhance competitive intensity. Management expects FY26 local sales growth of 9–10%, which would represent a meaningful turnaround for the industry.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.