Key Takeaways:

• Sales expected at PKR 7 Bn in FY25.

• Margins expected to remain sustainable at 26%.

• Efforts being made to sell Hi-Tech Alloy Wheels Subsidiary. (Book Value PKR 3.4/Share independent of debt component)

• All OEMS are either customers or in negotiations with management.

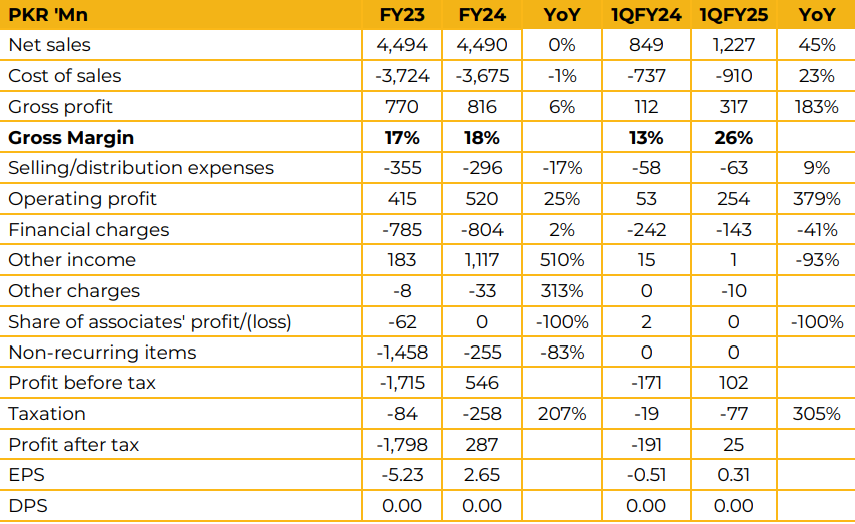

Loads Limited reported earnings per share of PKR 2.65 in FY24 against a loss per share of PKR 5.23 in FY23.

The company reported revenue of PKR 4.49 Bn in FY24 against PKR 4.49 Bn in FY23.

Gross margin for FY24 clocked in at 18% up from 17% in FY23. In 1QFY25 the gross margin has expanded to 26%. This was on the back of price revisions with OEMs in the exhaust and sheet metal components segment. Moving forward the management expects these margins to sustain.

In FY24, the company sold PKR 2.65 Bn of exhaust systems as compared to PKR 2.69 Bn in FY23. On the other hand, sales of sheet metal components were recorded at PKR 1.7 Bn in FY24 against PKR 1.4n Bn in FY23. Radiator sales saw a steep drop from PKR 397 Mn in FY23 to PKR 130 Mn in FY24.

The contribution by customer to revenue was as follows in FY24:

1) Suzuki: 56% (FY23: 54%)

2) Indus Motor: 24% (FY23: 22%)

3) Honda: 14% (FY23: 12%)

Loads is the only provider of exhaust systems to OEMs in the country and as such management believes that when localization begins for new OEM models all manufacturers will have to engage with the company.

Management highlighted that major new entrants such as Sazgar, KIA, Dewan and Changan have already reached out for localization of their parts and negotiations are ongoing.

It is pertinent to note that the company is also providing exhaust systems for Corolla Cross SUV, a newer HEV model introduced to the market by Toyota.

The company is also looking to sell its subsidiary Hi-tech Alloy Wheels within the next 3-6 months. The facility is currently 90% complete.

The book value of this investment is PKR 860 Mn (PKR 3.4/Share) along with PKR 2.7 Bn(PKR 10.7/Share) of debt extended to it of which PKR 1.4 Bn(PKR 5.57/Share) is remaining after write-offs as of Sep-24.

Going forward, management expects revenue for FY25 to clock in at about PKR 7 Bn representing a 55% growth in revenues this year as the auto sector sales continue their recovery.

The company also hopes to move into the aluminum radiator segment in the future.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.