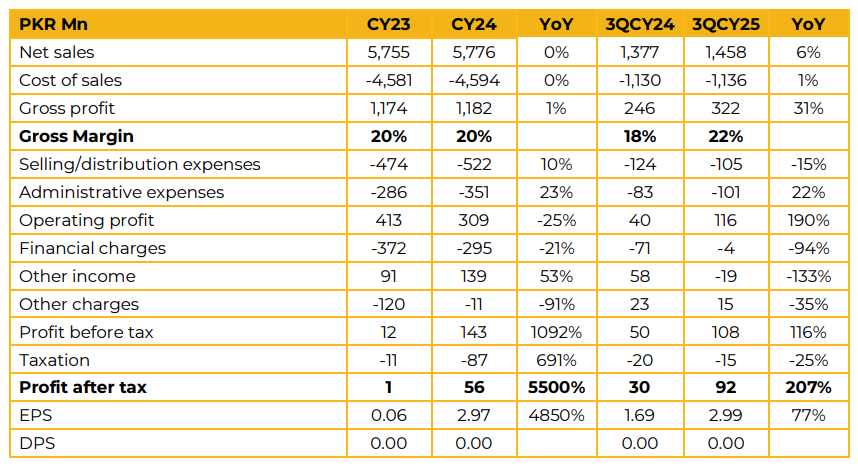

KSB Pumps Company Limited recorded earnings per share of PKR 2.97 in CY24, as compared to PKR 0.06 in CY23. The company recorded net sales of PKR 5.8 Bn, in line with PKR 5.8 Bn in CY23. During CY24, the company’s gross margin also remained stable at 20% in line with CY23.

Along with this, it saw its gross profit increase 1% from PKR 1,174 Mn in CY23 to PKR 1,182 Bn in CY24. KSBP posted profit after tax of PKR 56 Mn in CY24, compared to PKR 1 Mn in CY23. The company underwent a rights issue in CY24 in order to finance working capital and reduce debt levels. As a result, the company has substantially reduced finance costs.

Management highlighted that the business has improved in all aspects with growth in exports, local sales and margins in all divisions. It was also highlighted that the orders in hand as of Sep-2025 stood at PKR 4.1 Bn compared to PKR 3.7 Bn at Sep2024. With regards to exports, it was revealed that the company benefits from the licensing of the parent group which allows it to sell to partners in other regions as each local partner is only allowed to produce selected products by the parent company.

The company is also in the process of developing and getting approvals for more export items including castings for group companies after which it expects strong growth in export sales. In the local market, for government contracts it was highlighted that competitors import goods which takes 8-10 weeks to ship whereas the company benefits from a monthlong delivery cycle allowing it to serve customers more effectively.

Public sector spending has seen an uptick in water-based projects in Punjab and Sindh which is driving sales growth in the local market. With regards to mining, it was apprised that projects like Reko Diq may not utilize a lot of the company’s production due to the company not locally producing the required pumps.

However, they would still supply the same after importing from group companies and benefit from the enhancement of the services portfolio. Going forward, management was of the view that they will significantly grow their sales in CY26 with the gross margin to remain stable at 22% or improve further. The company is targeting a 40% sales contribution from exports in the future in order to develop a sustainable business model which is not severely impacted by slowdowns in local sales.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.