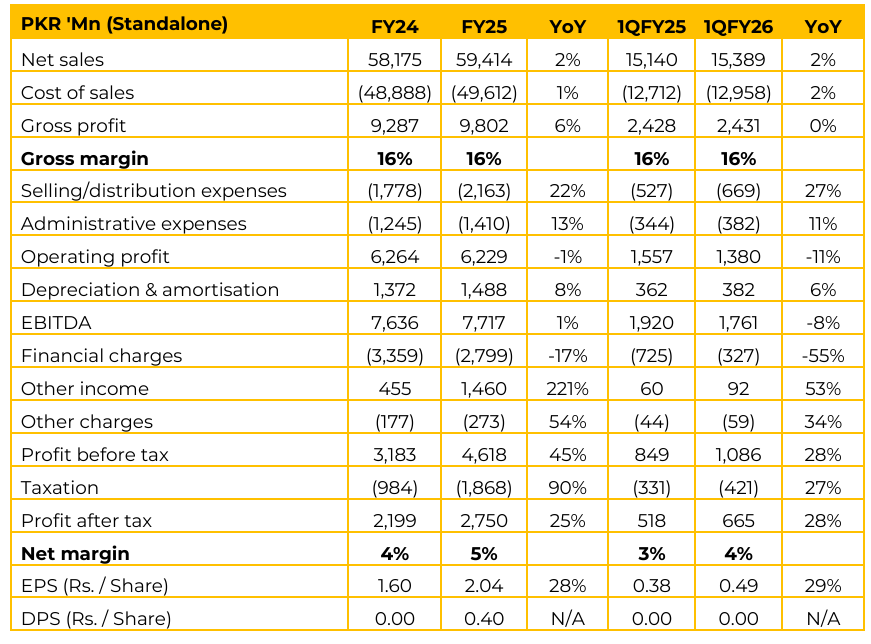

KTML has reported standalone earnings per share of PKR 2.04 in FY25 (FY24: PKR 1.60). Furthermore, in 1QFY26 the company reported EPS of PKR 0.49 (1QFY25: PKR 0.38). KTML is the parent company of the Maple Leaf Group; holds 82.92% shares in Maple Leaf Capital and 57.9% shares in Maple Leaf Cement. KTML operates three main divisions (spinning, weaving and processing), supported by a power division.

Company’s net sales increased by 2% in FY25, mainly due to increase in exports. Gross profit also improved by 6% supported by increase in exports and reduction in utility prices. Under the home textile division, 100% of the bedware is exported. In spinning section 100% is local sales. Weaving division has a mix of local and export sales. Margins from weaving division significantly increased due to increase in exports, use of Chinese yarn as a raw material and reduction in power cost due to installation of solar capacity.

Total energy load is 24.56 MW, primarily relied on national grid due to the drop in WAPDA prices. Solar capacity increased to 5 MW (up from 3.5 MW previously) due to the installation of additional solar units. Average cost per unit in FY25 remained PKR 30.5 per kilowatt hour (down from PKR 34.2/Kwh in FY24). WAPDA rates dropped from PKR 39.7 per unit to PKR 35.9 per unit. Management claims that KTML is one of the lowest cost producers in the sector. KTML consistently generates a gross margin of 18-20% in textile. KTML is claimed to be the only textile mill in Pakistan with 5 MW of solar power installed.

They report being off the grid for 7-8 hours on sunny days (zero grid consumption). Net portfolio value of Maple Leaf Capital Limited (MLCL) was reported to be around PKR 27 billion. The capital gains generated by MLCL are taken into KTML’s income every year according to accounting standards; it is not a one-off event.

Management anticipates returns based on the PKR 27 billion net portfolio. The current dividend yield is about 7%, suggesting about 1.8 billion in returns. Management expects further capital gains (potentially 12%, 15%, 20%, or higher). MLCL’s The gross portfolio is estimated at PKR 35–40 billion. Futures/derivatives activity amounting to PKR 3–4 billion is considered low risk (less than 10%) as management employs a very conservative leveraging strategy. Management forecasts slightly weaker results for the spinning division in 2QFY26.

The drop is mainly attributed to the influx of Chinese yarn in the market, which depressed yarn selling prices. As a counter-strategy, KTML has stopped producing finer yarn where the price differential is huge and is moving towards coarser yarn, where the difference between Chinese and Pakistani yarn prices is less. KTML utilizes its recycling facility for coarser counts. Management highlighted that the government is mulling on reducing the utility cost. They are giving the incremental unit benefit of 28.98 rupees per kilowatt hours.

So, if that benefit is transferred or passed on to textile companies that will also contribute positively towards the spinning results. Home textile margins are decreasing because the local inflation (7–10%) is not covered by revenue, which is in dollars. The government is keeping the dollar exchange rate “very tight,” meaning the company receives less local currency for the same volume of exports, further pressuring margins.

Regarding the current electricity subsidy announcement by the government, the management noted that the current package requires a 25% increment in utility consumption to receive the reduced rate. Management does not expect to benefit significantly as their utilization of electricity from the grid has not varied significantly. Talking hypothetically, the management noted that the government might give a blanket PKR 5 per unit relief in electricity prices in winter for industrial consumption. If such happens and KTML increases the utilization, the company could see a benefit of PKR 300 – 500 million. Management confirms that capex spending is prioritized and sustainable.

Focus is on procuring machinery that is more energy efficient and overall efficient in terms of manpower. KTML is availing subsidized loans from the State Bank, currently at a 3% discount. KTML generates about PKR 4 billion in cash annually, and capex is usually kept at 25% to 30% of this cash generation. Calculated returns and payback periods for major investments are around four to five years for both the weaving and spinning divisions. Going forward, the company is planning to replace 274 looms that are more than 5 years old with automated new machines to increase efficiency, production, and reduce utility prices. Maple Leaf

Capital’s portfolio return is contingent upon the performance of the stock market, on which management feels positive for the near future.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.