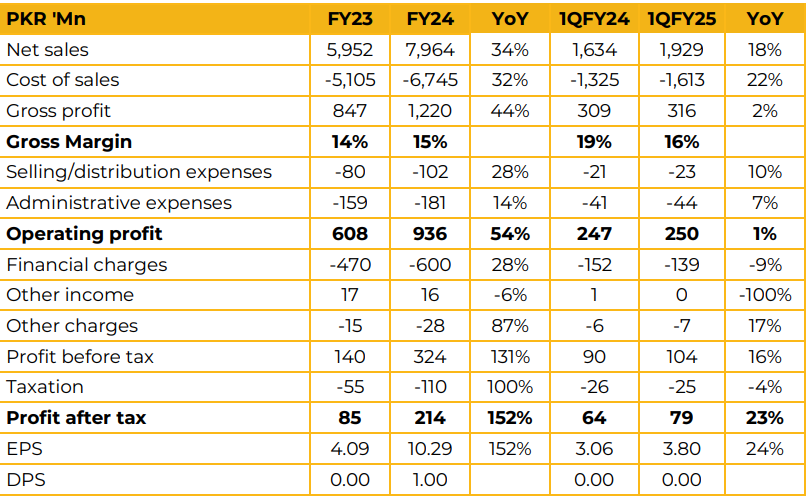

Kohat Textile Mills Limited reported earnings per share of PKR 10.29 in FY24 against PKR 4.09 in FY23, an increase of 152%. Revenue in FY24 was recorded at PKR 7.96 Bn, up 34% from PKR 5.95 Bn in FY23.

The company saw its gross margin expand from 14% in FY23 to 15% in FY24. The company derives 20% of its revenue from cotton yarnbased sales and the remaining is from the production of man-made fiber-based yarns.

Management informed that the company has brought online its latest 2.1 MW solar plant project to now have a total of 5.1 MW of solar capacity online. Apart from this the company also has a gas based captive power plant and a standby connection from WAPDA.

Management was of the opinion that captive power plants will hopefully not get disconnected as the government is currently negotiating with the IMF in this regard to save gas distribution companies from PKR 400 Bn losses. The company expects to sustain its margins if captive power plant gas supply is not shut.

It has attributed its enhanced margins to the efforts of all its functions including marketing and procurement. Going forward, the management expects its cash constraints issues to be resolved this year.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.