Kohat Cement’s total dispatches have declined over the past year, with a 14% decrease from FY23 to FY24, dropping from 3,000,545 metric tons to 2,585,786 metric tons. This downward trend continued into the first quarter of FY25, with dispatches falling 22% compared to the same period in FY24, from 761,623 metric tons to 591,620 metric tons. This is mainly due to the low demand in the construction sector.

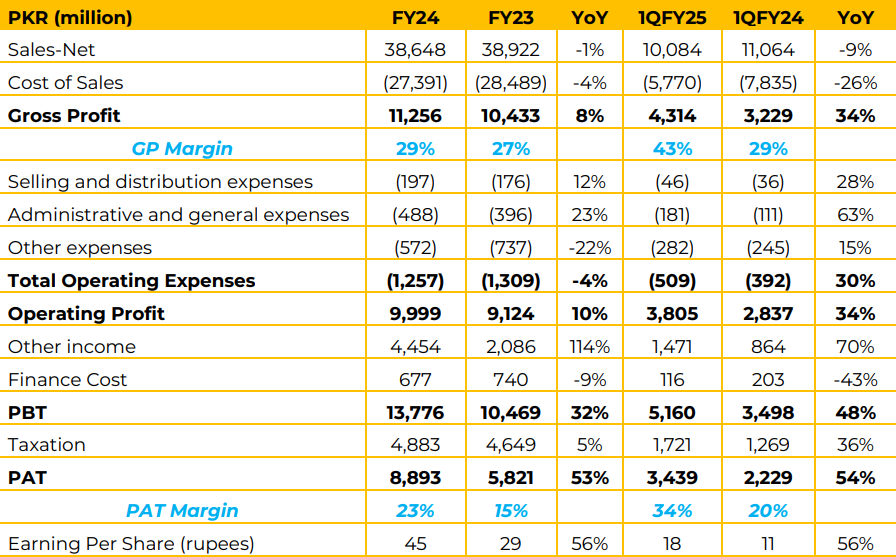

Similarly, in FY24, capacity utilization dropped to 51.5%, a 13.9% decrease from 59.8% in FY23. This trend has continued in the first quarter of FY25, where utilization fell further to 45.9%, down by 22.3% from 59.1% in 1QFY24. Company’s net sales in FY24 showed a slight decrease of 1%, reaching PKR 38,648 million from PKR 38,922 million in FY23. In 1QFY25, sales declined by 9% compared to 1QFY24, from PKR 11,064 million to PKR 10,084 million.

Despite the sharp decline in dispatches, the negative impact on sales was offset by high retention price. The cost of sales also decreased, down 4% YoY in FY24 and by a notable 26% in 1QFY25. This decrease is attributed to the reduction in prices of coal. Other income surged by 114% in FY24 and 70% in 1QFY25, driven by efficient management of investments, which were primarily parked in mutual funds. However, the management expects this to decline, inline with the declining interest rates.

PAT for FY24 reached PKR 8,893 million, a substantial 53% increase from FY23. PAT in 1QFY25 grew by 54% YoY to PKR 3,439 million, and PAT margins improved from 15% in FY23 to 23% in FY24, and further to 34% in 1QFY25. The company is progressing with the infrastructure for a Greenfield cement production line in Khushab, Punjab. However, the import of plant and machinery is on hold until the economic outlook stabilizes.

After successfully installing a 10MW solar power plant, Kohat Cement is adding another 10MW solar plant at its Kohat site. Solar panels and major equipment have been procured, and a contractor is installing a 6MW portion, expected to be completed by December 2024. This project will further reduce dependence on the National Grid, cutting costs and supporting sustainable energy use. The Board has approved a 30MW coal-fired power plant at the Kohat plant site. Contractors are engaged, and the Letter of Credit process is underway. The installation and commissioning are expected to take 18 months. This plant aims to reduce power costs and reliance on the National Grid, improving the company’s energy efficiency.

Going forward, given the high construction costs and substantial taxes and duties on property transactions, the management does not expect growth in the current financial year. These factors are likely to suppress demand in the construction sector, impacting gross margins and limiting expansion opportunities in the near term.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose