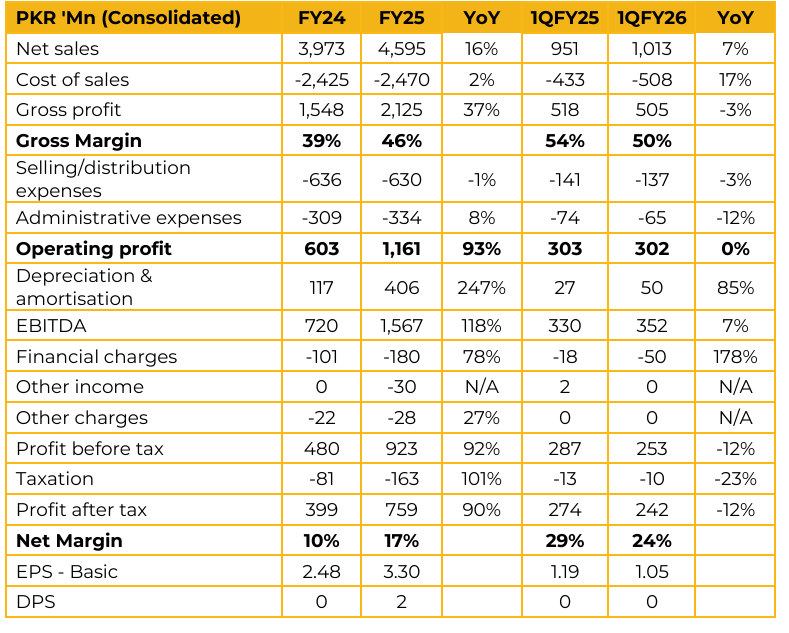

Image Pakistan Limited (IMAGE) reported consolidated earnings per share of PKR 3.30 for FY25, compared to PKR 2.48 in FY24. Furthermore, in 1QFY26, the company reported earnings per share of PKR 1.05, compared to earnings per share of PKR 1.19 in the same period last year (SPLY).

Management remains focused on expanding retail presence, enhancing online performance, and optimizing the product mix to drive growth. For FY26, the company has set a revenue target between PKR 5.0 – 5.5 billion, reflecting an expected 20% YoY growth over FY25 sales. Gross margins are projected to remain in line with FY25 levels. To support this growth, the company plans a significant expansion of its physical retail network, targeting 18 outlets by 1QCY26 across major cities, including Karachi, Lahore, Islamabad, Rawalpindi, Multan, Gujrat, Faisalabad, and Peshawar. Management indicated that the rent to sales ratio for their store at Dolmen Mall averages around 10%.

On the international front, the company is actively expanding its footprint in key markets such as the UK, USA, UAE, and the European Union, capitalizing on growing demand for its products. Additionally, there is a recognized opportunity in perfumes and lifestyle products. Management is currently in the product development phase and plans to introduce 3–4 new perfumes every quarter once the line is established, potentially within FY26.

Operationally, the company currently operates 72 multi-head embroidery machines and intends to add three more, bringing the total to 75. Financing arrangements are already in place with banks to support the import of additional machines if required for future expansion.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.