Key Takeaways:

• The company expects to launch new products in non-essential category

• The Newly Installed CaC plant would increase the capacity by 50%.

• The management expects to be leading multi vitamin brand in coming year

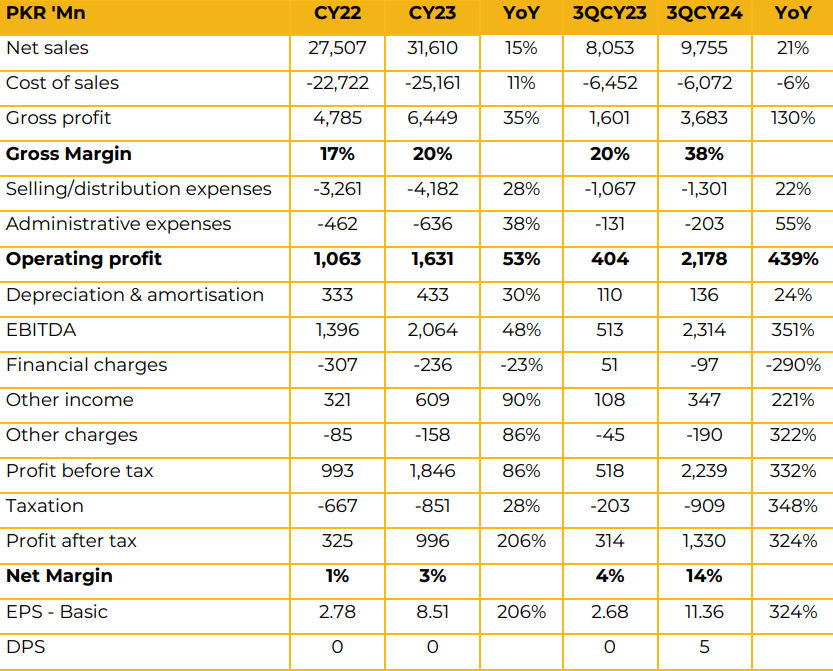

Haleon Pakistan limited reported Profit per share of PKR 8.51 in FY23 against a Profit per share of PKR 2.78 in FY22 depicting an increase of 206%.

Furthermore, in 3QFY24 the company reported Profit per share of PKR 11.36 against PKR 2.68 in SPLY. They mentioned that there were some quota issues regarding Panadol in last period that has now been resolved. They further added Panadol night and Panadol ultra is getting good response, In addition Panadol ultra has been launched in Karachi and will soon float in the market.

The management achieve significant volume growth in Q3 and expect reasonable growth in upcoming period. The net sales growth in the OTC segment was 18%, while the growth in FMCG categories was 7%, it was due to new product launches in FMCG.

Exports of company was impacted due to change in name from GlaxoSmithKline to Haleon, as regulatory requirements necessitated a transition period. The current portfolio composition includes 47% essential products, 38% non-essential products, 12% FMCG, and 4% toll manufacturing

The company achieved a gross margin of 23.3% in Q3, reflecting a 14.5% increase. This significant improvement in margins was driven by decrease in commodity prices, lower inflation rates, reduced finance costs, and price adjustments. Looking ahead, the company plans to expand its portfolio of non-essential products.

The newly installed CaC plant is the most efficient in the world, it has increased company CaC production capacity by 50%. Management expects to become the leading multivitamin brand in the next year. The issue related to the company’s dividend payments has been resolved, and they expect further that there would be no unpaid dividends. Going forward, the company plans to launch Centrum, anticipating it will become a blockbuster.

The initial phase will include the launch of Centrum Adult and Centrum Silver, with additional products to follow in two years. Additionally, the company also plans to introduce Robitussin under a local brand name, with freefall pricing.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.