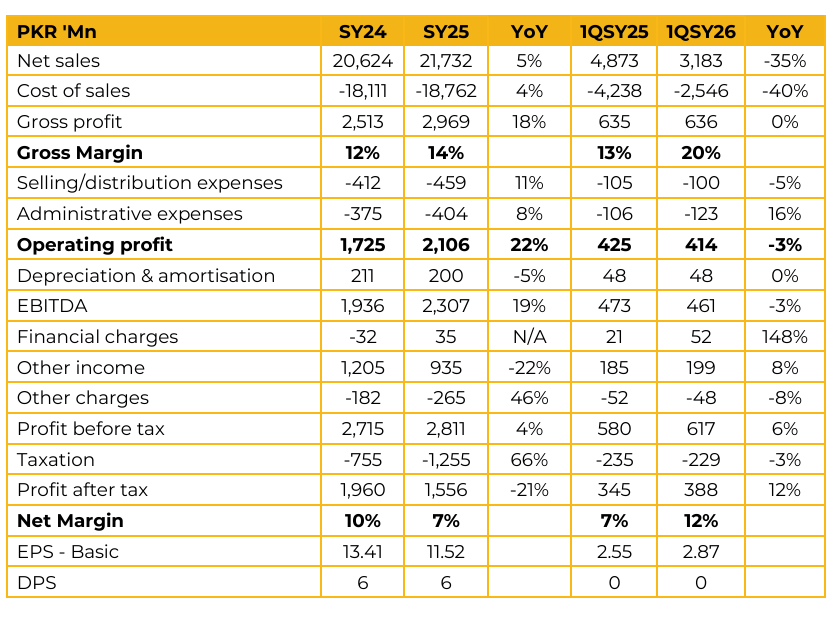

Habib Sugar Mills Limited (HABSM) reported earnings per share of PKR 11.52 for SY25, compared to earnings per share of PKR 13.41 in SY24. Furthermore, in 1QSY26, the company reported earnings per share of PKR 2.87, compared to earnings per share of PKR 2.55 in the same period last year (SPLY). As of 15 February 2026, the company has crushed 746,000 metric tons of sugarcane, resulting in the production of 79,000 metric tons of sugar.

The average sucrose recovery rate currently stands at 10.7%. The current average cost of production (before tax) is estimated at PKR 120 per kg. Over 90% of total sales are corporate, which allows for structured long term planning with clients based on their annual consumption requirements. Given these committed corporate contracts, management expects to realize an average selling price of PKR 135 per kg.

The ethanol division continues to operate in a challenging environment amid weak international pricing and evolving regulatory dynamics. The withdrawal of GSP+ benefits has necessitated a strategic shift in sales focus, with the company actively exploring new destinations, particularly in the Far East and Middle East regions. Molasses prices are currently ranging between PKR 26,000 and PKR 30,000 per ton.

Margin compression is anticipated, as molasses prices have not declined in line with ethanol prices. Additionally, competitive pressures on raw material procurement have intensified due to the entry of new distilleries, further impacting input cost dynamics. Sugar selling prices remain subject to government influence. As per management, the government has set the retail price at PKR 141 per kg and the wholesale price at PKR 138 per kg for the month of Ramadan. The sugar segment reflects relative pricing visibility through institutional contracts, the ethanol segment continues to face margin pressures due to external market and regulatory factors.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.