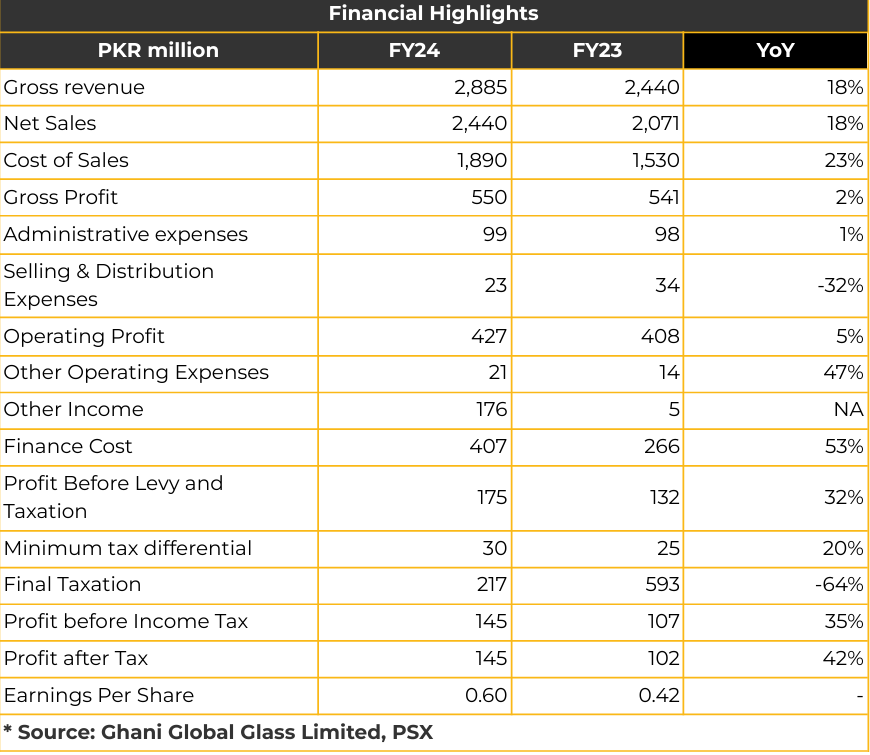

In FY24, Ghani Global Glass Limited (GGGL) reported a net profit of PKR 144.82 million (EPS: PKR 0.60),reflecting a 42% increase from PKR 101.88 million (EPS:PKR0.42) in the corresponding period last year. Gross profit grew by 2% YoY to PKR 549.89 million, compared to PKR 540.65 million during the same period. Operating profit increased by 5% YoY to PKR 427.12 million from PKR 408.04 million in the SPLY. However, finance costs surged 53% YoY to PKR 406.71million from PKR 266.08 million in the SPLY. Gross profit margins declined to 22.54% (FY23: 26.11%),while net profit margins improved to 6% in FY24, up from 4.92% in the SPLY. The asset turnover ratio was reported at 49.19 in FY24 compared to 47.11 in the SPLY. Current and quick ratios were 1.16 and 0.69, respectively, in FY24.Furnace capacity stands at 22 tons/day, with glass tube production capacity at 18 tons/day. According to management, the plants are operating at optimum capacity. Total current assets and liabilities were reported at PKR 2.66 billion (FY23: PKR 2.14 billion) and PKR2.29 billion (FY23: PKR 1.85 billion), respectively. Management reported that GGGL holds a 70% market share of the Chinese glass tube market, while its share in the European glass tube market is 15-20%.The company manufactures ampoules and vials from in-house glass tubes and operates 16 Chinese and Indian ampoule machines, along with five vial machines. Ampoule’s production capacity exceeds 40 million units per month. To enhance production capacity, GGGL plans to import six state-of-the-art ampoule machines from Europe. Two machines are expected to arrive in October this year, with operations expected to commence by year-end. This expansion will increase ampoule production capacity from 40 million units per month to 55 million. The total capex for the new ampoule machines is reported at PKR 250 million, with an additional PKR 350 million allocated for the BMR of the existing furnace. GGGL serves several multinational and national companies, providing import substitutes for glass tubing. To boost exports, the company is negotiating with consumers in the MENA region, Africa, Latin America, and South Asia. Going forward, GGGL plans to enhance profit margins through investments in high-tech ampoule machines and the expansion of production capacity to meet rising local demand and boost exports. The company also targets increasing its European Glass Tube market share to 50%within the upcoming 1-2 years

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a

position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this

report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose