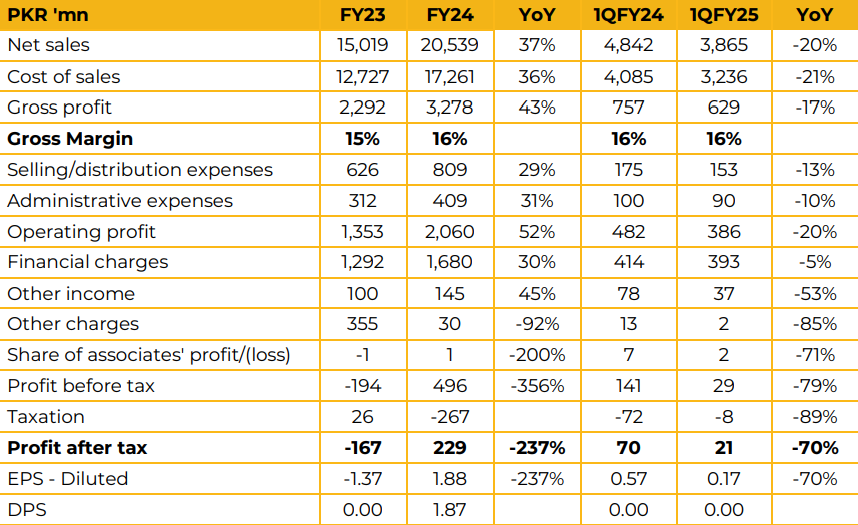

Ghandara Tyre & Rubber Company Limited reported earnings per share of PKR 1.88 in FY24 against a loss per share of PKR 1.37 in FY23, depicting an increase of 237%.

The company saw its gross margins increase to 16% in FY24 from 15.3% in FY23 on the back of easing commodity prices. GTYR is in the process of executing its solar energy agreement with KE for 2MW and expects this to be up and running by March 2025.

The company has also begun supplying 17-inch tyres to OEMs and excavator and OTR tyres in the replacement market. The management was of the opinion that lower sales in the first quarter of this year were due to lower farm sales as a result of the wheat price crash affecting rural demand.

The company has recently entered into a 7-year technical services agreement with Shandong Huasheng Rubber Company Limited as a replacement for Continental Global Holding Netherlands B.V.

The management is hopeful that this new partner will be able to provide newer designs and technology with faster testing services as their testing facility is operational all year. The new partner operates in over 100 countries with annual sales of over a billion dollars.

Management estimated that its two largest product segments are farm tyres and passenger car tyres with them contributing two thirds of revenue.

GTYR is in the process of scouting for export markets and is currently visiting exhibitions. The company plans to focus more on the replacement and export markets as they provide stable revenues.

It was also revealed that the company is now supplying tyres for the Corolla Cross as well as Honda HR-V and is collaborating with OEMS for more SUV and crossover tyres.

In this regard the management apprised that for large scale production of larger tyres such as 18-inch capex will be needed.

Previously due to the high cost of borrowing this project had been on hold but now, with the expected drop in interest rates management expects that this project can be started soon.

Going forward, the management expects lower borrowing costs to support profitability and the change in parent to lead to a gradual positive impact as well.

The company plans to make further inroads with exports and OTR and excavator tyres. They are also in the process of developing EV tyres and hope they will be able to enter this segment in the future.

Management also expects margins to remain stable as long as the exchange rate and oil prices remain stable.

Important Disclosures

Disclaimer:

This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for

information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or

solicitation or any offer to buy. While reasonable care has been taken to ensure that the information

contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes

no representation as to its accuracy or completeness and it should not be relied upon as such. From time

to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have

a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of

this report Chase Securities as a firm may have business relationships, including investment banking

relationships with the companies referred to in this report This report is provided only for the information

of professional advisers who are expected to make their own investment decisions without undue reliance

on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect

consequential loss arising from any use of this report or its contents At the same time, it should be noted

that investments in capital markets are also subject to market risks This report may not be reproduced,

distributed or published by any recipient for any purpose.