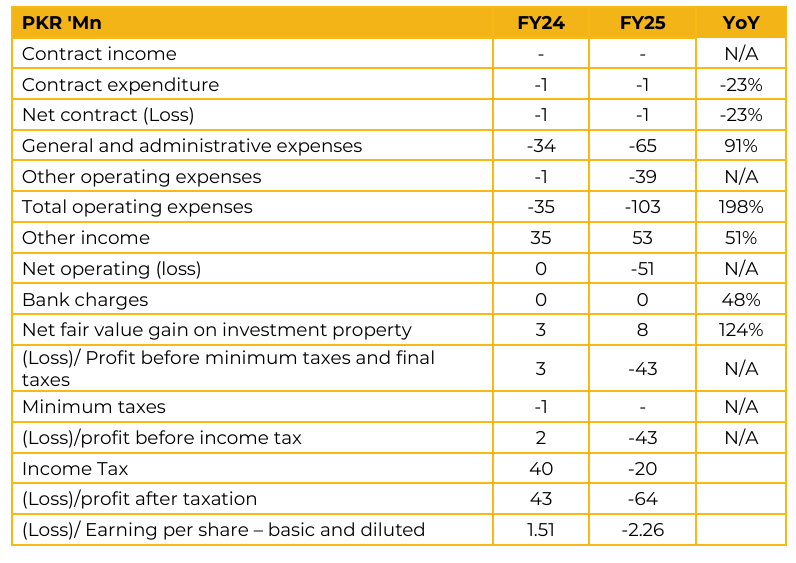

Gammon Pakistan Limited (GAMON) reported loss per share of PKR 2.26 for FY25, compared to earnings per share of PKR 1.51 in FY24. The company currently has no projects in hand, and the reported revenue was generated entirely from asset sale proceeds. The Maritime Technologies Complex Project was formally closed during the period, resulting in the receipt of PKR 6.9m. The realized value of PKR 155m came in below the initial valuation reports, creating a meaningful variance.

Management attributed this to ongoing legal and administrative costs, as well as challenges arising from land-grabbing, which complicated the sale process. A total of PKR 64.5m (out of an approved PKR 90.5m) has been disbursed as a loan to the subsidiary, Gammon Pakistan Pre-Cast (Pvt.) Ltd, for construction of a shed intended to generate rental income. Upon completion, the subsidiary expects to deliver PKR 1m per month in rental income.

The company also spent PKR 55.5m on renovating the Gammon House building to enhance its commercial value and improve rental potential. Additionally, PKR 5m was utilized to settle recoveries payable to the FBR, while PKR 23.5m was paid to a local party engaged to facilitate completion of the plot sale process and help resolve local issues.

Management expects improvement driven by the Government of Pakistan’s planned investments in infrastructure, energy, education, and housing. Key risk includes working capital shortage, which could negatively impact future performance. In addition, ongoing nationwide political and economic instability poses a threat to the broader business environment.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.