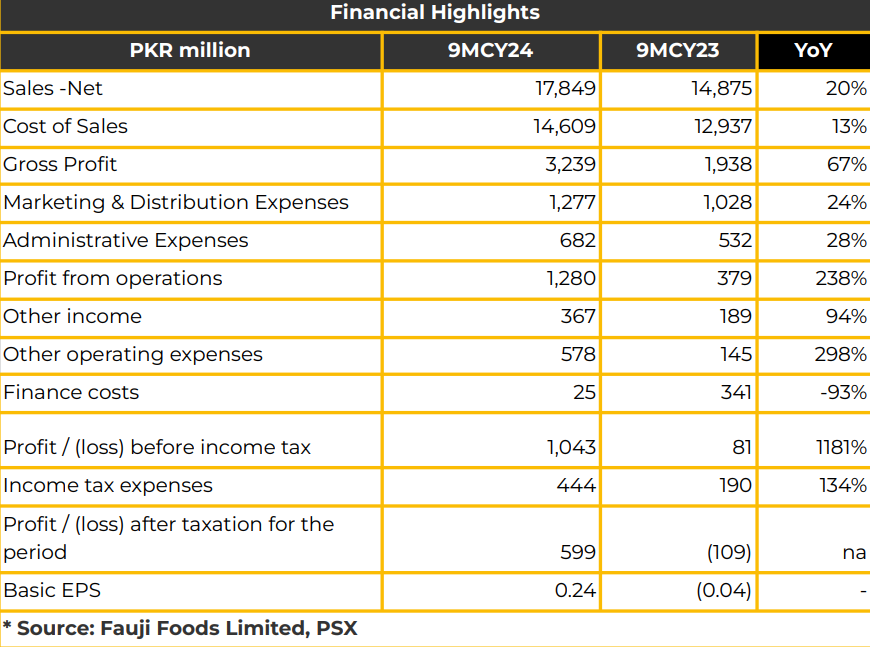

In 9MCY24, Fauji Foods Limited (FFL) reported a net profit of PKR 598.83 million (EPS: PKR 0.24), marking a substantial improvement from the net loss of PKR 108.75 billion (LPS: PKR 0.04) in the same period last year. FFL’s revenue increased by 20%, reaching PKR 17.85 billion in 9MFY24, a significant 83% YoY rise from PKR 8.07 billion reported in the previous year.

Category-wise revenue includes PKR 6.00 billion from the dairy business and PKR 426 million from cereals in 3QCY24. Volume-wise, revenue was 57 million litres, showing a 15% YoY growth from 49.63 million litres in the SPLY. Gross profit margins improved from 13% to 18%. In February, FFL acquired the cornflakes and cereal business within the group, where it now holds the largest market share.

Additionally, FFL launched new products in desi ghee and pasta this week. NurPur UHT experienced 51% YoY growth in value (SPLY: 92%) and 34% growth in volume (SPLY: 39%) in FY24, despite the impact of an 18% GST implementation. FFL has also invested PKR 149 million in financial institutions from finance income, generating income.

The Company’s primary focus is on enhancing its value-added portfolio with new, margin-accretive product launches. FFL recently developed a strategic partnership with the Royal Group of China for buffalo milk and that company installed new packing machinery at the FFL plant. FFL plans to begin exporting buffalo milk to China by year-end.

FFL reported vertical integration with four group companies, where Fongrow grows crops as raw material input. FFL aims to generate PKR 0.5 billion over the next year through synergies within this vertical integration.

Pasta is expected to contribute to revenue within 13-14 months, with management projecting substantial top and bottom-line growth in the next 12-18 months. FFL currently holds a 14-15% market share in dairy products. Management disclosed that milk accounts for 70% of total costs, with packaging at 10-15%.

Management affirmed their dividend-paying capacity but plans to prioritize stabilization over the next two years before resuming payouts. Going forward, FFL is focused on cost optimization and aims to transform into a food and beverage powerhouse, expanding beyond liquid dairy to achieve a PKR 100 billion growth target in five years.

This roadmap includes acquisitions, margin-focused categories, and distribution growth, with further expansion plans in the pipeline. Revenue from the pasta business is anticipated to commence by the end of November.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.