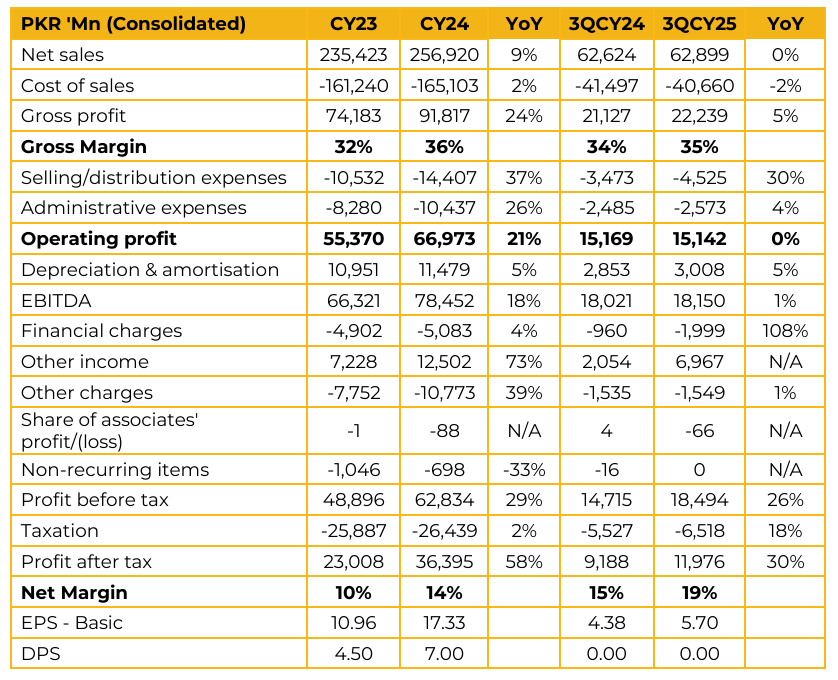

Fatima Fertilizer Company Limited Limited (FATIMA) reported earnings per share of PKR 17.33 for CY24, compared to earnings per share of PKR 10.96 in CY23. Furthermore, in 3QCY25, the company reported earnings per share of PKR 5.70, compared to earnings per share of PKR 4.38 in the same period last year (SPLY). Despite a declining market, Fatima expanded its total market share by 4.4ppt to 30.1%.

This includes a 40.9% share in phosphates and 26.9% share in nitrogen. All three plants that is Sadiqabad, Multan, and Sheikhupura have secured and consistent gas supply, which remains critical to sustaining production volumes and operational stability. Fatima, alongside other industry participants, is investing in a USD 300 million capex project for a pressure enhancement facility at the Mari gas field.

Management believes this will improve long term supply stability, potentially securing gas availability for at least the next 10 years. Management expects a strong December and a positive next year supported by the government’s wheat reference price of PKR 3,500 per 40kg, which should improve farmer liquidity. On exports, management noted that there are currently no plans for urea exports from Pakistan.

The company was part of a consortium in a landmark privatisation transaction for PIA. Management emphasized that the primary objective is to execute a turnaround. Detailed financials and the consortium’s stake allocation are expected to be finalized within the 90 day period following the bid.

The company has secured copper and gold exploration licenses in Balochistan. Management views this as a long term opportunity, with an initial 3–4 year exploration phase before any development decisions. The group is establishing Fatima Capital Limited, a new listed entity to manage all investments. This will allow the investment portfolio to be reported separately from the core fertilizer operations.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.