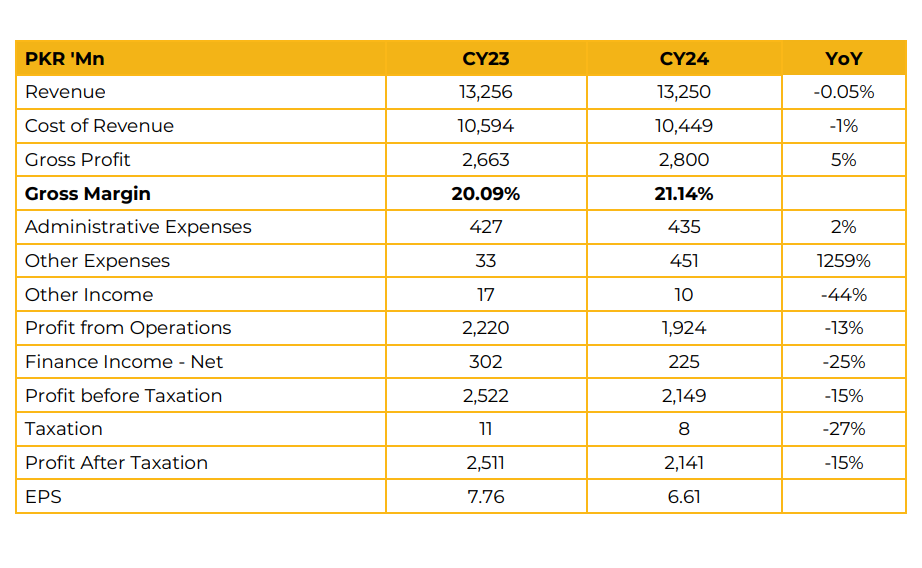

EPQL posted a net profit of PKR 2.14 billion (EPS: PKR 6.61) in CY24, reflecting a 15% decline from PKR 2.51 billion (EPS: PKR 7.76) in the previous year. The decrease in profitability was attributed to provisions recorded in light of ongoing renegotiations with IPPs. Revenue remained stable at PKR 13.25 billion in CY24. A decline in revenue, driven by lower dispatch and capacity payments, was partially offset by an increase in tariff. NEPRA issued its decision in February 2024 on the Fuel Cost Component for gas to be supplied by PEL.

The Gas Sale & Purchase Agreement with PEL was successfully concluded in August 2024, with the low-BTU gas price set at USD 5.6 per mmbtu.

The company is actively engaging with regulatory bodies to commence operations. EPQL maintained 100% plant availability and ensured uninterrupted dispatches due to its high merit order position in CY24. The billable availability factor remained at 100% during the year. Net electrical output declined to 847 GWh in CY24 from 870 GWh in CY23, reflecting a marginal dip in gas availability. Similarly, the load factor decreased to 45% from 46% due to lower dispatches in 1QCY24 amid weak demand. The receivables collected in each quarter were PKR 11.24 billion, PKR 10.54 billion, PKR 10.58 billion, and PKR 9.47 billion.

Outstanding receivables from SNGPL stand at PKR 8.2 billion, expected to be settled within 90 days by April or midMay. In response to recent tariff changes Management refuted a recent article regarding IPP payments as misleading, clarifying that payments have not yet been received. EPQL is implementing operational efficiencies to reduce costs. The company’s business outlook remains sustainable for the next three years with PEL gas supply, which is expected to as PEL expands production from its various fields.

EPQL is participating in the insurance premium tariff bidding, capped at 0.9% of EPC. Under the revised tariff structure, fuel savings are not expected to change as there is no alteration in the fuel component. Qadirpur gas supply at a 45% load factor is projected to remain stable, with no further depletion right now. Any increase in gas prices is not expected to impact merit order, except in the case of lower imported coal prices. Looking ahead, the management plans to finalize an alternate fuel option in 1HCY25 and commence operations in 2HCY25. Key agreements are expected to undergo amendments, with a NEPRA hearing anticipated soon.

The company is also exploring alternative local fuel sources. Energy demand is expected to recover in 2025 as macroeconomic indicators improve. The company’s strategic focus remains on increasing the load factor and enhancing operational efficiencies.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.