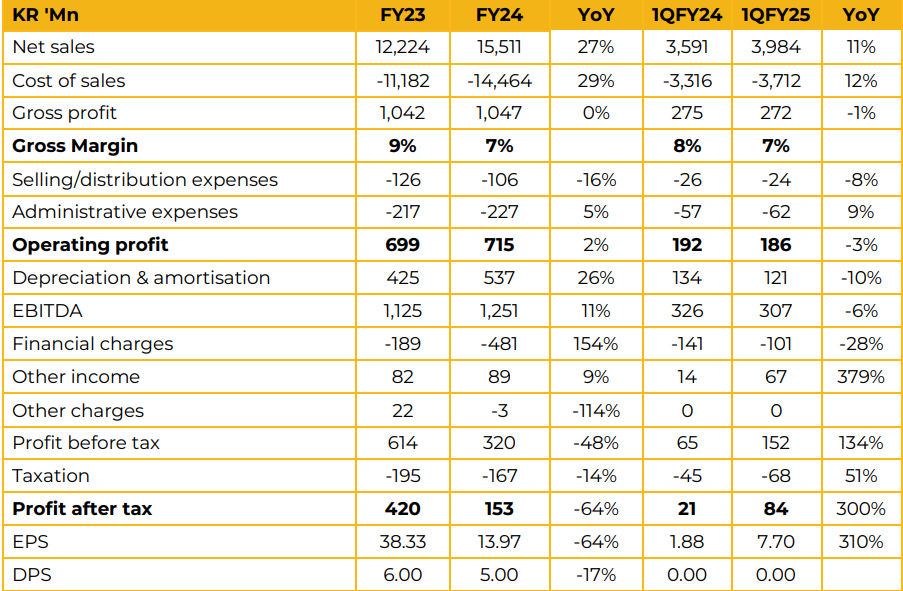

Ellcot Spinning Mills Limited reported earnings per share of PKR 13.97 in FY24 against earning per share of PKR 38.33 in FY23, a decrease of 64%. Furthermore, in 1QFY25 the company has reported earning per share of PKR 7.70 against earning per share of PKR 1.88 in SPLY.

Total revenue in FY24 reached PKR 15.5 Bn against PKR 12.2 Bn in FY23, an increase of 26.93%. The company saw its gross margin drop from 8.52% in FY23 to 6.75% in FY24.

Company announced the dividend of PKR 5.00 per share in FY24 as of PKR 6.00 per share in FY23. Ellcot Spinning Mills operates 79,200 spindles equipped with advanced technology for producing high-quality yarn using 100% synthetic cotton blends.

The company’s production capacity in making yarn is 17,000 tonnes per annum. The company identified key challenges, including low yarn demand, volatile cotton prices, and high energy costs, which significantly raise production expenses. Local cotton crop failures have forced the company to rely heavily on imports. While international cotton prices have dipped by 15-16% year-over-year. However, company reported that they have made timely purchases at right times. Looking ahead, the company anticipates a potential decline in cotton crop output due to climate change.

To address this, Ellcot is exploring opportunities to capitalize on lower international cotton prices by maximizing its procurement

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.