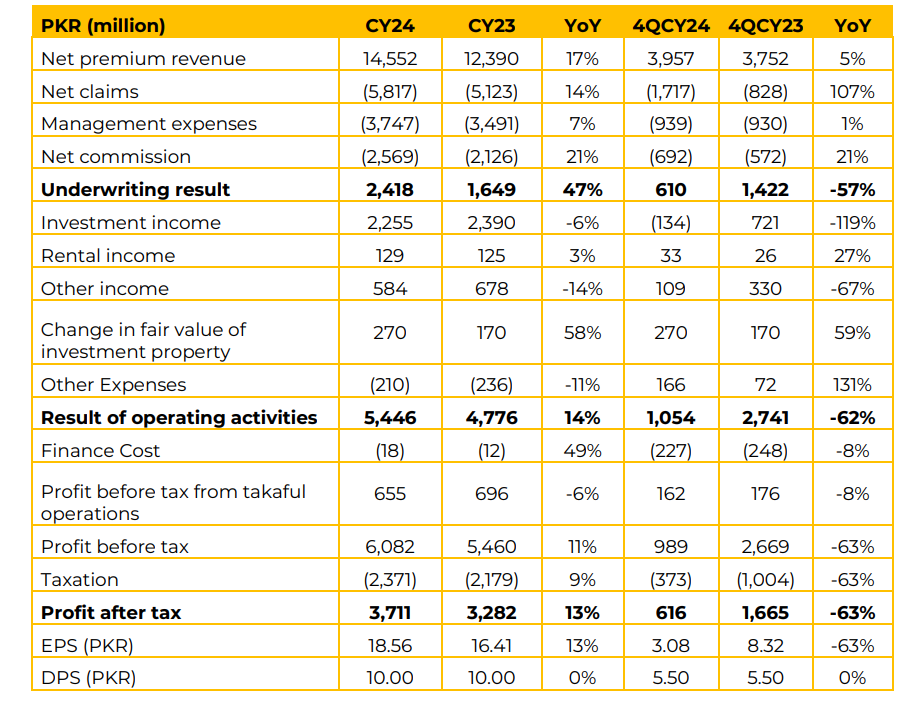

EFU General Insurance reported a profit after tax of PKR 3.71 billion for CY24, representing a 13% YoY increase from PKR 3.28 billion in CY23. Earnings per share (EPS) rose to PKR 18.56 compared to PKR 16.41 last year. The dividend was maintained at PKR 10.00 per share. Net premium revenue grew 17% YoY, reaching PKR 14.55 billion as a result of expanding the reinsurance structure of the company.

The segment-wise breakdown of net premium revenue is as follows: Fire and Property was the largest contributor with 49% (up from 43% in CY23), Motor contributed 28% (down from 31%), Marine accounted for 14% (down from 16%), and Miscellaneous segments stood at 9% (down slightly from 10%). Net claims rose by 14% YoY to PKR 5.82 billion, with the claims ratio improving slightly in the Motor and Miscellaneous segments, partially offset by higher claims in Marine. Net commission expenses saw a notable increase of 21% YoY to PKR 2.57 billion, while management expenses rose by 7% YoY to PKR 3.75 billion. The underwriting result improved significantly by 47% YoY, totaling PKR 2.42 billion, driven primarily by enhanced profitability in Fire and Property and Motor segments.

Investment income decreased by 6% YoY to PKR 2.26 billion, impacted by volatility in the equity market, although income from debt securities and term deposits notably increased to PKR 2.11 billion from PKR 1.71 billion. Additionally, the fair value gain on investment property rose sharply by 58% YoY to PKR 270 million Going forward, the company eyes to maintain their leadership position.

The company claims to have a market share of 19.5% of the private sector’s non-life insurance business within Pakistan. The management anticipates that their Net Premium Revenue will continue to grow. Moreover, the company is looking to focus on customer satisfaction, risk management and enhancing shareholder’s value.

Important Disclosures

Disclaimer: This report has been prepared by Chase Securities Pakistan (Private) Limited and is provided for information purposes only. Under no circumstances, this is to be used or considered as an offer to sell or solicitation or any offer to buy. While reasonable care has been taken to ensure that the information contained in this report is not untrue or misleading at the time of its publication, Chase Securities makes no representation as to its accuracy or completeness and it should not be relied upon as such. From time to time, Chase Securities and/or any of its officers or directors may, as permitted by applicable laws, have a position, or otherwise be interested in any transaction, in any securities directly or indirectly subject of this report Chase Securities as a firm may have business relationships, including investment banking relationships with the companies referred to in this report This report is provided only for the information of professional advisers who are expected to make their own investment decisions without undue reliance on this report and Chase Securities accepts no responsibility whatsoever for any direct or indirect consequential loss arising from any use of this report or its contents At the same time, it should be noted that investments in capital markets are also subject to market risks This report may not be reproduced, distributed or published by any recipient for any purpose.